44 relationship between coupon rate and ytm

Solved Bond Prices versus Yields A. What is the ... - Chegg Expert Answer 100% (4 ratings) A. YTM is based on the current market rate. Price of the bond is decided by the prevailing market rate which is YTM. If the YTM is higher than coupon rate, the price of the … View the full answer Previous question Next question Relation Between Bond Price and Yield - Risk and Return Further, YTM also assumes that the coupon amount earned by you periodically is re-invested in the same debt instrument at the prevailing market prices. Hence, the calculation of YTM is different from that of the current yield. YTM is considered as one of the most accurate return measure from an investment in a bond Price determination

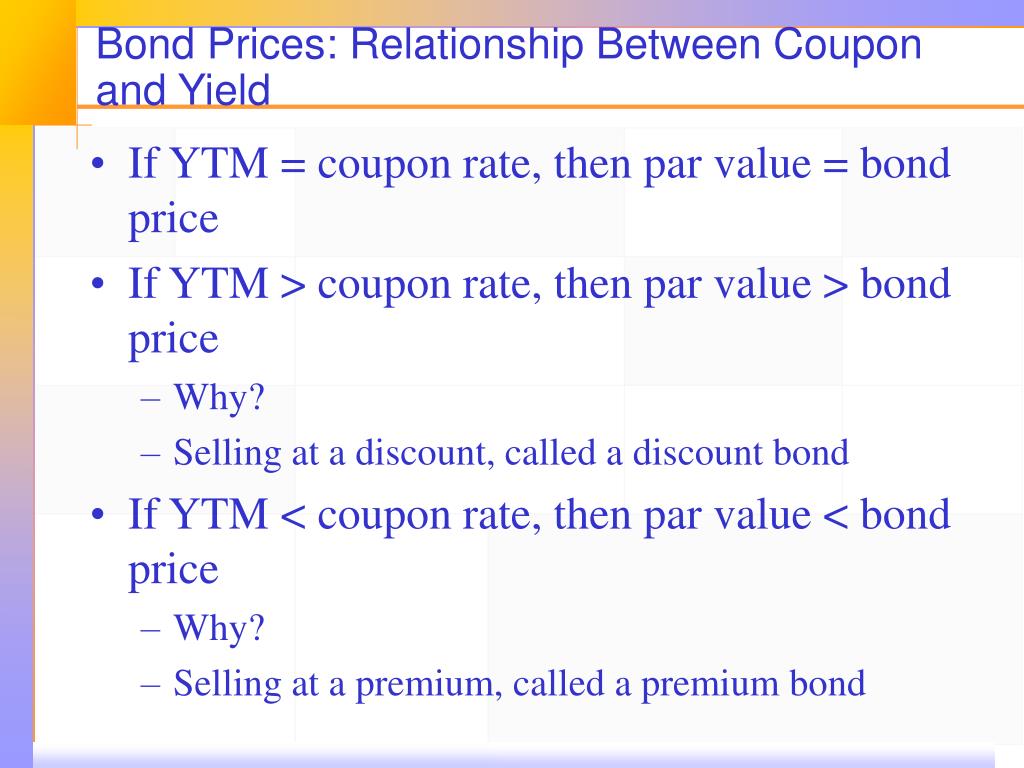

Important Differences Between Coupon and Yield to Maturity Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%).

Relationship between coupon rate and ytm

The Relation of Interest Rate & Yield to Maturity ... Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and maturity date. In the example, if you paid a premium for the same six-year bond, say $101, your estimated YTM would decrease to about 4.8 percent, or about $28.80. What is the relationship between YTM and the discount rate ... The term yield-to-maturity is commonly used for coupon-paying bonds. It's the interest rate that discounts all the future cash flows of the bond to its present value. It is the r in the following formula. [math] PV=\left [\sum_ {i=1}^ {n}\frac {C} { (1+r)^i} \right ]+\frac {FV} { (1+r)^n} [/math] Solved (1) What is the relationship between the coupon ... Experts are tested by Chegg as specialists in their subject area. We review their content and use your feedback to keep the quality high. I'm answering the first question as per the guidelines of Chegg. Please post separate questions. 1. The relationship between the coupon rate of the bond and the yield to maturity of the bond in terms of the ...

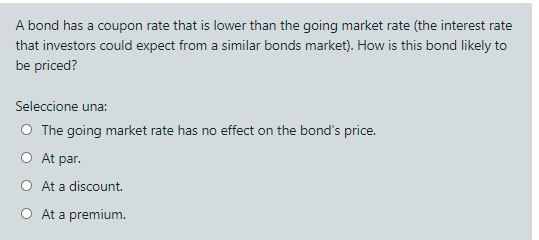

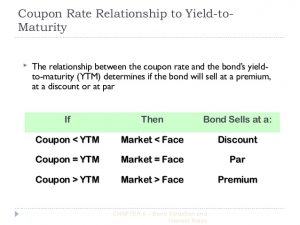

Relationship between coupon rate and ytm. Concept 82: Relationships among a Bond's Price, Coupon ... The relationship between a bond's price and its YTM is convex. Percentage price change is more when discount rate goes down than when it goes up by the same amount. Relationship with coupon rate A bond is priced at a premium above par value when the coupon rate is greater than the market discount rate. Solved what relationship exists between the coupon ... Current value $480 Years to maturity Par value $500 Coupon interest rate 13% a. Calculate the yield to maturity (YTM) for the bond. b. What relationship exists between the coupon interest rate and yield to maturity and the par value and market value of a bond? Explain. b. The Relation of Interest Rate & Yield to Maturity ... This is because it still pays the same fixed coupon of each year (5 percent of the par value). To earn 6 percent, a smaller investment - a lower bond price -- is necessary, because bond prices ... Relationship between Current Yield Yield to Maturity and ... when a bond sells at par, its current yield = coupon rate = yield to maturity when it sells at a discount, its yield to maturity > current yield > coupon rate when it sells at a premium, its coupon rate > current yield > yield to maturity conventions in calculation of accrued interest and price to be paid if a trade takes place on the date when …

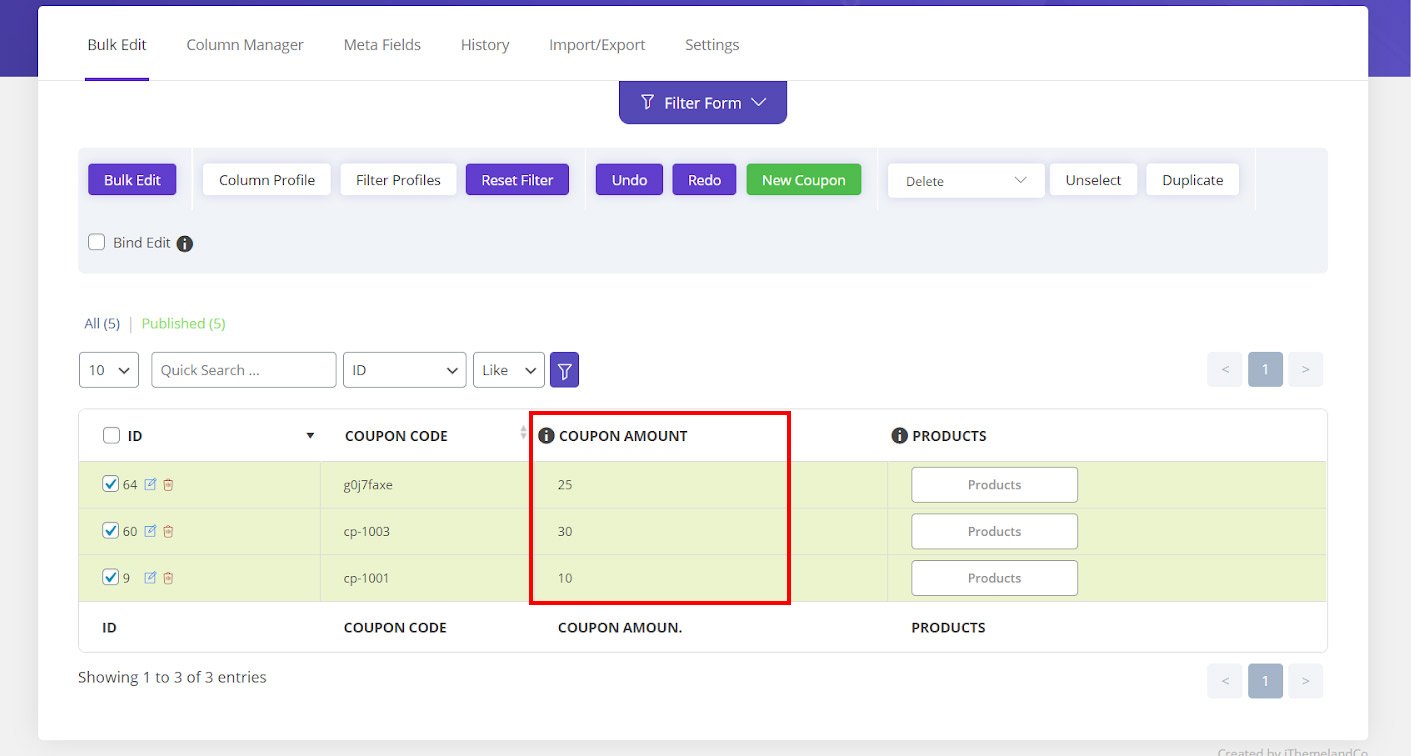

Relationship Between Coupon and Yield - Assignment Worker Coupon rate = 14%, semiannual coupons YTM = 16% Maturity = 7 years Par value = $1,000 Slide 14 6-14 Example 7.1 • Semiannual coupon = $70 • Semiannual yield = 8% • Periods to maturity = 14 • Bond value = • 70 [1 - 1/ (1.08)14] / .08 + 1000 / (1.08)14 = 917.56 ( ) ( )2t 2t 2 YTM1 F 2 YTM 2 YTM1 1 -1 2 C Value Bond + + + = Coupon Rate - Learn How Coupon Rate Affects Bond Pricing The coupon rate represents the actual amount of interest earned by the bondholder annually, while the yield-to-maturity is the estimated total rate of return of a bond, assuming that it is held until maturity. Most investors consider the yield-to-maturity a more important figure than the coupon rate when making investment decisions. What is the relation between the coupon rate on a bond and ... A bond's yield to maturity (YTM) is the internal rate of return required for the present value of all the future cash flows of the bond (face value and coupon payments) to equal the current bond price. YTM assumes that all coupon payments are reinvested at a yield equal to the YTM and that the bond is held to maturity. Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. A...

Returns, Spreads, and Yields | AnalystPrep - FRM Part 1 ... If the coupon rate < YTM, the bond will sell for less than par value, or at a discount. If coupon rate= YTM, the bond will sell for par value. Over time, the price of premium bonds will gradually fall until they trade at par value at maturity. Similarly, the price of discount bonds will gradually rise to par value as maturity gets closer. Solved Yield to maturity The Salem Company bond currently ... Transcribed image text: Yield to maturity The Salem Company bond currently sells for $931.02, has a coupon interest rate of 9% and a $1000 par value, pays interest annually, and has 12 years to maturity. a. Calculate the yield to maturity (YTM) on this bond. b. Explain the relationship that exists between the coupon interest rate and yield to maturity and the par value and market value of a ... Understanding Bonds: The Relationship Between Yield and ... New bonds will have to pay a 7% coupon rate or no one will buy them. By the same token, you could sell your 6% bond only if you offered it at a price that produced a 7% yield for the buyer. So the ... Yield to Maturity (YTM): Formula and Excel Calculator The coupon payments were reinvested at the same rate as the yield-to-maturity (YTM). Said differently, the yield to maturity (YTM) on a bond is its internal rate of return (IRR) - i.e. the discount rate which makes the present value (PV) of all the bond's future cash flows equal to its current market price. Yield to Maturity (YTM) Formula

Relationship between ratings and yield to maturity - A ... To fill out the first table, you will need to select 3 bonds with maturities between 10 and 20 years with bond ratings of A to AAA, B to BBB and C to CC (you may want to use bond screener at the Web site linked above). All of these bonds will have these values (future values) of $1,000. You will need to use a coupon rate of the bond times the ...

The Relationship Between a Bond's Price & Yield to Maturity The Relationship Between a Bond's Price & Yield to Maturity When you buy a bond, an important part of your return is the interest rate that the bond pays. However, yield to maturity is a more accurate representation of the total return you'll get on your investment.

Coupon vs Yield | Top 5 Differences (with Infographics) The yield to maturity (YTM) refers to the rate of interest used to discount future cash flows. read more is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic Let's see the top differences between coupon vs. yield.

The Relationship Between Yield Duration and Maturity ... FIGURE 6.1 Relationships between Macaulay Duration and Maturity. It's true - given the same coupon rate and yield, the 20-year bond actually does have the higher percentage price increase for the same drop in yield, 5.85% compared to 5.46%. Try to explain this without appealing to duration. I have tried to do so but cannot.

Difference Between Coupon Rate And Yield Of Maturity The major difference between coupon rate and yield of maturity is that coupon rate has fixed bond tenure throughout the year. However, in the case of the yield of maturity, it changes depending on several factors like remaining years till maturity and the current price at which the bond is being traded. Conclusion

What relationship between a bond's coupon rate and a bond ... Answer (1 of 5): If yield is higher than the coupon rate then the bond is trading at a discount. Let's say you own a bond that you paid $1,000 for and it has a coupon rate of 10%. That means that this Bond will pay $100 per year in interest no matter what its price on the market. Therefore , you...

Solved (1) What is the relationship between the coupon ... Experts are tested by Chegg as specialists in their subject area. We review their content and use your feedback to keep the quality high. I'm answering the first question as per the guidelines of Chegg. Please post separate questions. 1. The relationship between the coupon rate of the bond and the yield to maturity of the bond in terms of the ...

What is the relationship between YTM and the discount rate ... The term yield-to-maturity is commonly used for coupon-paying bonds. It's the interest rate that discounts all the future cash flows of the bond to its present value. It is the r in the following formula. [math] PV=\left [\sum_ {i=1}^ {n}\frac {C} { (1+r)^i} \right ]+\frac {FV} { (1+r)^n} [/math]

The Relation of Interest Rate & Yield to Maturity ... Most brokerage firms offer YTM estimates on potential purchases, and there are number of online calculators you can use to make estimates based on coupon rate and maturity date. In the example, if you paid a premium for the same six-year bond, say $101, your estimated YTM would decrease to about 4.8 percent, or about $28.80.

/GettyImages-551987971-41276ca6a78044ab857859bb9f4e0ac1.jpg)

Post a Comment for "44 relationship between coupon rate and ytm"