40 zero coupon convertible bond

The One-Minute Guide to Zero Coupon Bonds | FINRA.org zero-coupon bond on the secondary market will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond with a face value of $10,000. Record run for zero-rate convertible bonds hits a wall - OLTNEWS Prior to 2020, a zero-coupon convertible bond was a rarity. Between 2009 and 2019, only 18 companies issued convertible bonds that paid no interest, according to JPMorgan data. In 2020, there were 22 such offers. In 2021, there were 45. Among them: In March 2021, DraftKings raised nearly $1.3 billion with a zero-coupon convertible.

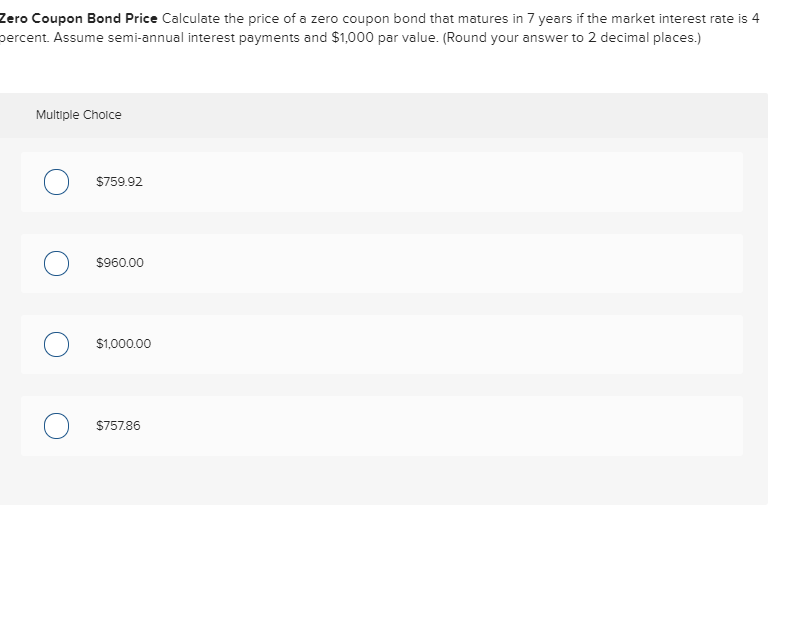

Value and Yield of a Zero-Coupon Bond | Formula & Example The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ...

Zero coupon convertible bond

Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond. Zero-Coupon Convertible Due to the zero - coupon feature, the bond pays no interest and is issued at a discount to par value, while the convertible feature means that the bond is convertible into common stock of the issuer at a certain conversion price. The zero - coupon and convertible features offset each other in terms of the yield required by investors. MicroStrategy Completes $1.05 Billion Offering of Convertible Notes at ... MicroStrategy Completes $1.05 Billion Offering of Convertible Notes at 0% Coupon and 50% Conversion Premium with Bitcoin Use of Funds. Press Release | February 19, 2021. PDF Version. ... The notes are convertible into cash, shares of MicroStrategy's class A common stock, or a combination of cash and shares of MicroStrategy's class A common ...

Zero coupon convertible bond. 14.3 Accounting for Zero-Coupon Bonds - Financial Accounting This zero-coupon bond was sold for $2,200 below face value to provide interest to the buyer. Payment will be made in two years. The straight-line method simply recognizes interest of $1,100 per year ($2,200/2 years). Figure 14.11 December 31, Years One and Two—Interest on Zero-Coupon Bond at 6 Percent Rate—Straight-Line Method Journal Entry for Zero Coupon Bonds - Accounting Education Before passing the journal entry, we should understand the the basic terms in zero coupon bonds. 1. Face Value. Face value is the future value which will be paid by company to the investors who invested their money in zero coupon bond. This bond is just like loan which is taken by company. At the time or repayment, this face value will be paid ... What is zero interest fully convertible bond? A zero-coupon convertible is a convertible bond issued by a corporation that pays no regular interest to bondholders. Because of the zero-coupon feature, these convertibles are sold at a discount and will instead mature to face value if they are not converted prior to the maturity date. Zero-coupon convertible bond - TheFreeDictionary.com Zero-Coupon Convertible Bond 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. They tend to be volatile in the secondary market because the convertible option may or may not become worthwhile, depending on how the company is performing.

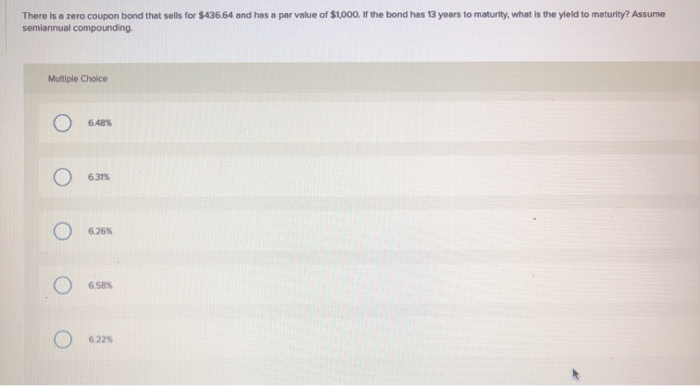

Zero coupon convertibles do not have a zero cost Zero coupon convertibles do not have a zero cost Published 11 May 2021 Convertible bond issuance is at a record high, with companies 'benefiting' from low interest rates and high equity volatility. A recent $1.44bn convertible bond issue by Twitter, with a zero coupon and conversion premium of 67%, is a good example. Zero Coupon Convertible Bond - Financial Dictionary Zero-Coupon Convertible Bond 1. A bond that may be converted into common stock in the company issuing it. A zero-coupon convertible bond is sold at a discount from par and matures at par. They tend to be volatile in the secondary market because the convertible option may or may not become worthwhile, depending on how the company is performing. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Zero Coupon Convertible.docx - What Is a Zero-Coupon... A zero-coupon convertible is a proper pay instrument that joins the highlights of a zero - coupon bond with that of a convertible bond . Because of the zero- coupon highlight , the bond pays no interest and is thusly given at a markdown to standard worth , while the convertible component implies that bondholders have the choice to change over bonds into normal load of the guarantor at a ...

Zero Coupon Bond | Investor.gov Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. MicroStrategy Completes $1.05 Billion Offering of Convertible Notes at ... MicroStrategy Completes $1.05 Billion Offering of Convertible Notes at 0% Coupon and 50% Conversion Premium with Bitcoin Use of Funds. Press Release | February 19, 2021. PDF Version. ... The notes are convertible into cash, shares of MicroStrategy's class A common stock, or a combination of cash and shares of MicroStrategy's class A common ... Zero-Coupon Convertible Due to the zero - coupon feature, the bond pays no interest and is issued at a discount to par value, while the convertible feature means that the bond is convertible into common stock of the issuer at a certain conversion price. The zero - coupon and convertible features offset each other in terms of the yield required by investors. Zero Coupon Bond (Definition, Formula, Examples, Calculations) Zero-Coupon Bond (Also known as Pure Discount Bond or Accrual Bond) refers to those bonds which are issued at a discount to its par value and makes no periodic interest payment, unlike a normal coupon-bearing bond. In other words, its annual implied interest payment is included in its face value which is paid at the maturity of such bond.

Post a Comment for "40 zero coupon convertible bond"