40 coupon rate semi annual

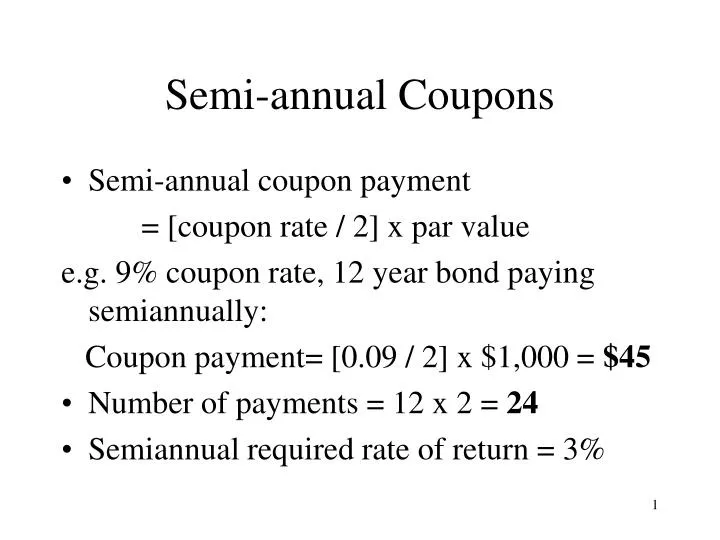

What is a Coupon Rate? | Bond Investing | Investment U Coupon Rate = Total Coupon Payments / Par Value. For example, if a company issues a $1,000 bond with two $25 semi-annual payments, its coupon rate would be $50/$1000 = 5%. Rates come fixed from the point of issuance; still, it's important to understand how to calculate them when evaluating fixed-income investments through different lenses ... Coupon Bond - Guide, Examples, How Coupon Bonds Work The issuer of the bond agrees to make annual or semi-annual interest payments equal to the coupon rate to investors. These payments are made until the bond's maturity. Let's imagine that Apple Inc. issued a new four-year bond with a face value of $100 and an annual coupon rate of 5% of the bond's face value.

Semi-Annual Coupon Rate Definition | Law Insider Related to Semi-Annual Coupon Rate. Semi-Annual Period means each of: the period beginning on and including January 1 and ending on and including June 30; and the period beginning on and including July 1 and ending on and including December 31.. Coupon Rate has the meaning set forth in Section 2.8.. Average Annual Bonus means the average of the annual bonuses from the Company earned by the ...

Coupon rate semi annual

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities. Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate. Solved 7. Jaeger, Inc. bonds have a 6.39% coupon rate with | Chegg.com Partzman Co. paid a dividend of $4.52 on its common stock at the end of last year. The company's dividends are expected to grow at a constant rate of 4% indefinitely. If the required rate of return on this stock is 18%, compute the current value per share of Partzman Co. stock. Submit your answer in dollars and round to two decimal places (Ex ...

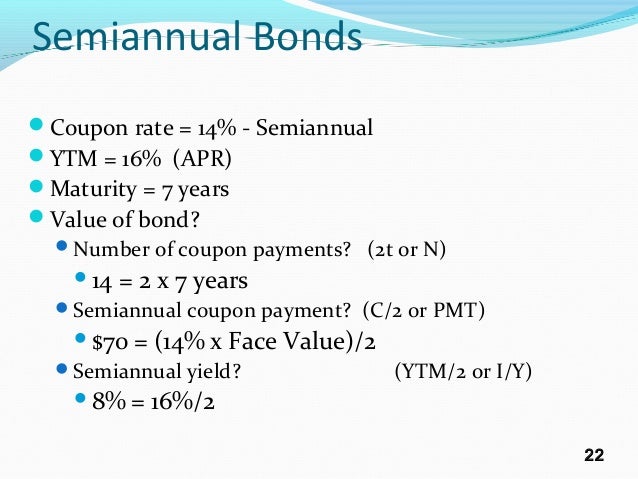

Coupon rate semi annual. Coupon Rate Calculator | Bond Coupon As this is a semi-annual coupon bond, our annual coupon rate calculator uses coupon frequency of 2. And the annual coupon payment for Bond A is: $25 * 2 = $50. Calculate the coupon rate; The last step is to calculate the coupon rate. You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment ... How to Calculate Semi-Annual Bond Yield | The Motley Fool Its coupon rate is 2% and it matures five years from now. To calculate the semi-annual bond payment, take 2% of the par value of $1,000, or $20, and divide it by two. The bond therefore pays $10 ... How to Calculate Coupon Rate in Excel (3 Ideal Examples) Here, we will calculate the coupon bond price of zero, annual, and semi-annual coupon bonds. So, without any delay, let's follow the steps below. STEPS: In the beginning, we will determine the price of a semi-annual coupon bond. To do so, select Cell C11 and type the formula below: How to Calculate the Price of Coupon Bond? - WallStreetMojo It determines the repayment amount made by GIS (guaranteed income security). Coupon Rate = Annualized Interest Payment / Par Value of Bond * 100% read more. Example #2. Let us take an example of bonds issued by company ABC Ltd that pays semi-annual coupons. Each bond has a par value of $1,000 with a coupon rate of 8%, and it is to mature in 5 ...

Coupon Rate: Formula and Bond Nominal Yield Calculator Coupon Rate = Annual Coupon / Par Value of Bond. For example, if the coupon rate on a bond is 6% on a $100k bond, the coupon payment comes out to $6k per year. Par Value = $100,000. Coupon Rate = 6%. Annual Coupon = $100,000 x 6% = $6,000. Since most bonds pay interest semi-annually, the bondholder receives two separate coupon payments of $3k ... Semi-annual rate - ACT Wiki - Treasurers Coupon rates on bonds paying interest twice per year are generally expressed as semi-annual rates. ... Example: Semi-annual rate calculation. For example if the semi-annual rate is quoted as 4%, then the periodic interest accruing is: = 4% x (6/12) = 2% per six month period. A semi-annual rate is an example of a nominal annual rate. Coupon Rate Formula | Step by Step Calculation (with Examples) The formula for coupon rate is computed by dividing the sum of the coupon payments paid annually by the par value of the bond and then expressed in terms of percentage. Coupon Rate = Total Annual Coupon Payment / Par Value of Bond * 100%. You are free to use this image on your website, templates etc, Please provide us with an attribution link. Semi-Annual Bond Basis (SABB) Definition - Investopedia Semi-Annual Bond Basis - SABB: A conversion metric to compare rates on bonds with varying characteristics. Since bonds come with all types of coupon rates and payment frequencies, it's important ...

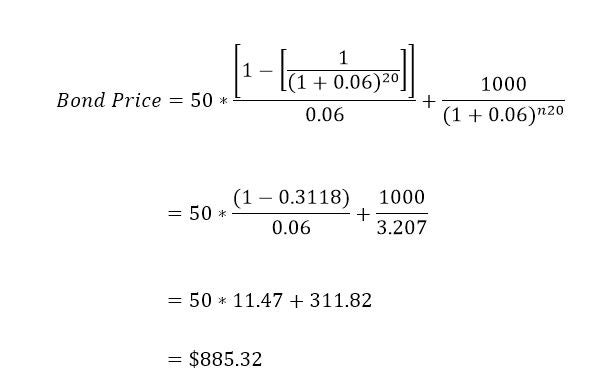

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter When we aim to get a zero coupon bond price calculator semi-annual, the easy way is to have the coupon rate on the bond and then divide it by the present price of the bond to obtain yield. ... As coupon rates are fixed in terms of yearly interest payments, that's why it is necessary to divide the rate by two, to have the semi-annual payment ... Zero-Coupon Bond - Definition, How It Works, Formula Example 2: Semi-annual Compounding. John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? 5*2 = $781.20. The price that John will pay for the bond today is $781.20. Reinvestment Risk and ... Bond Price Calculator - Belonging Wealth Management A bond's coupon is the interest payment you receive. Use the simple annual coupon payment in the calculator. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency. For most bonds, this is semi-annual to coincide with the fact that you receive two annual coupon ... Yield to Maturity Calculator | Good Calculators C is the periodic coupon payment, r is the yield to maturity (YTM) of a bond, B is the par value or face value of a bond, Y is the number of years to maturity. Example 2: Suppose a bond is selling for $980, and has an annual coupon rate of 6%. It matures in five years, and the face value is $1000.

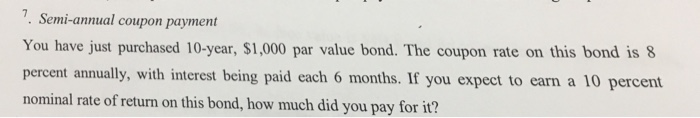

Solved 1. Analyze the 20-year, 8% coupon rate (semi-annual | Chegg.com 1. Analyze the 20-year, 8% coupon rate (semi-annual payment), $1,000 par value bond. The bond currently sells for $1,115. What's the bond's yield to maturity?

How to Calculate the Price of a Bond With Semiannual Coupon Interest ... In addition to getting semi-annual interest payments, bond issuers promise to repay the face value of bonds to investors at maturity. ... Because semiannual coupon payments are paid twice per year, your required rate of return, mathematically speaking, must be cut in half. Therefore, the example's required rate of return would be 2.5 percent ...

How to Calculate a Coupon Payment: 7 Steps (with Pictures) 1. Use the coupon rate and the face value to calculate the annual payment. If you know the face value of the bond and its coupon rate, you can calculate the annual coupon payment by multiplying the coupon rate times the bond's face value. For example, if the coupon rate is 8% and the bond's face value is $1,000, then the annual coupon payment ...

Coupon Rate Definition - Investopedia Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ...

What is the coupon rate for a bond that has semi-annual coupon payments ... Question What is the coupon rate for a bond that has semi-annual coupon payments, a yield to maturity of 6.549% , is priced at $899.67 and has 6 years to

What Is Coupon Rate and How Do You Calculate It? A bond with semi-annual to annual coupon payments can provide a steady stream of income with the right coupon rate. ... To calculate the bond coupon rate we add the total annual payments then divide that by the bond's par value: ($50 + $50) = $100; The bond's coupon rate is 10 percent. This is the portion of its value that it repays ...

Semiannual coupon and annual coupon | Forum | Bionic Turtle The meaning of 10% semiannual coupons is that the bond pays coupon at 10% of face value per year compounded semiannually. So the rate is 5% per semiannual period which is used to pay coupon at end of each half year. so that for a bond with face value 100 with 10% semiannual couponsmeans that coupons are paid semiannually (at end of each half ...

Coupon Rate - Meaning, Calculation and Importance - Scripbox The coupon payments are semi-annual, and the semi-annual payments are INR 50 each. To calculate the couponrate for Company A's bond, we need to know the total annual interest payments. Total Annual Interest Payments = 50 + 50 = 100. Coupon Rate = 100 / 500 * 100 = 20%. Therefore, the coupon rate for the Company A bond is 20%.

Bond Price Calculator Coupon rate is the annual rate of return the bond generates expressed as a percentage from the bond's par value. Coupon rate compounding frequency that can be Annually, Semi-annually, Quarterly si Monthly. Market interest rate represents the return rate similar bonds sold on the market can generate. This figure is used to see whether the bond ...

Bond Prices: Annual Vs. Semiannual Payments - Pocketsense A bond with semiannual payments would have a higher price than a bond with annual payments when they both are selling at a premium. Bonds can sell at a premium only when their market interest rates are lower than the coupon rate. In general, bonds with semiannual payments are more sensitive to changes in market interest rates.

PDF PS WF 2YNC6M FIXED RATE Callable Semi-annual coupons 27JUL22 78014RFK1 We may call the Notes in whole, but not in part, beginning on January 29, 2023, and semi-annually thereafter upon 10 business days' prior written notice. All payments on the Notes are subject to our credit risk. ... PS WF 2YNC6M FIXED RATE Callable Semi-annual coupons_27JUL22_78014RFK1

Solved 7. Jaeger, Inc. bonds have a 6.39% coupon rate with | Chegg.com Partzman Co. paid a dividend of $4.52 on its common stock at the end of last year. The company's dividends are expected to grow at a constant rate of 4% indefinitely. If the required rate of return on this stock is 18%, compute the current value per share of Partzman Co. stock. Submit your answer in dollars and round to two decimal places (Ex ...

Coupon Rate Calculator | Calculate Coupon Rate - AZCalculator Online coupon rate calculation. Use this simple finance coupon rate calculator to calculate coupon rate.

Coupon Rate Formula | Calculator (Excel Template) - EDUCBA Coupon Rate = (Annual Coupon (or Interest) Payment / Face Value of Bond) * 100. Coupon Rate = (20 / 100) * 100. Coupon Rate = 20%. Now, if the market rate of interest is lower than 20% than the bond will be traded at a premium as this bond gives more value to the investors compared to other fixed income securities.

Post a Comment for "40 coupon rate semi annual"