43 how to calculate zero coupon bond price

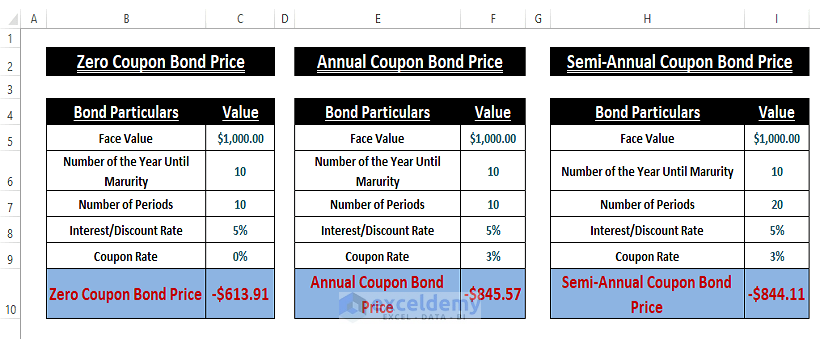

How to Calculate Discount Rate in - jxwsy.autohelp.fr Step 3: Calculate Process: it is the value. A bond's coupon is the interest payment you receive. Use the simple annual coupon payment in the calculator. If your bond has a face, or maturity, value of $1,000 and a coupon rate of 6% then input $60 in the coupon field. Compounding Frequency. For most bonds, this is semi-annual to coincide with the ... Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53, The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding,

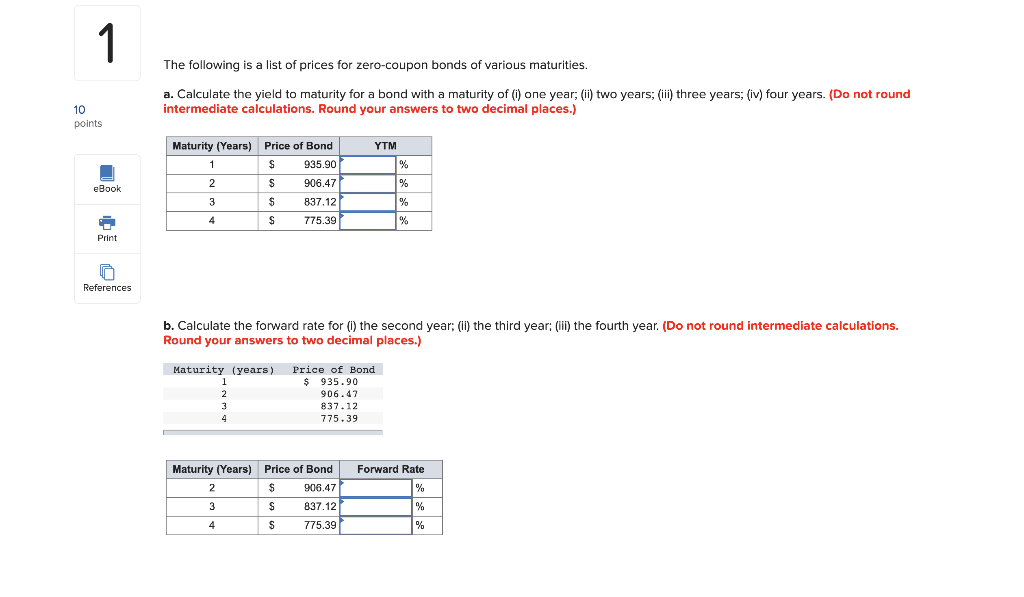

How to Price a Bond Using Spot Rates (Zero Curve) The simplest way to calculate the value of a bond is to take the cash flows of the bond till its maturity and then discount them by a single discount rate. The method is quick but not very accurate because the yield curve is not flat and the interest rates are different for different maturities. ... (zero coupon rate) for its respective ...

How to calculate zero coupon bond price

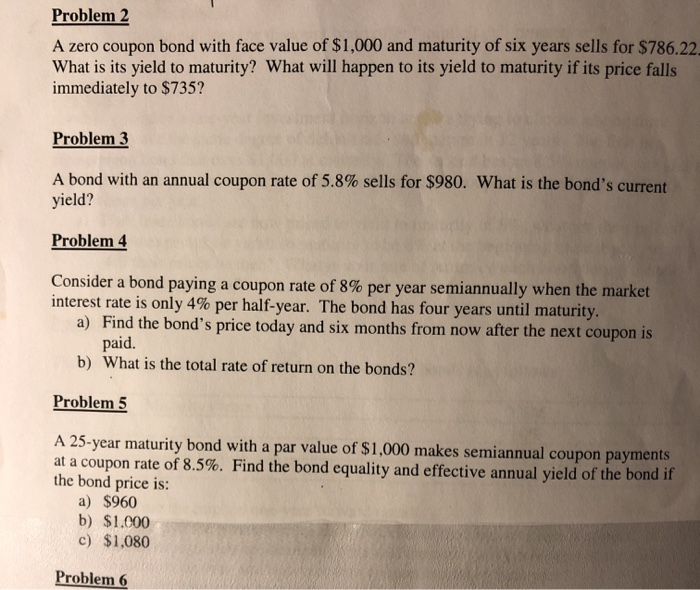

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula, Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1, Interest Rate Risks and "Phantom Income" Taxes, How to Calculate the Price of a Zero Coupon Bond To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures. The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

How to calculate zero coupon bond price. Zero Coupon Bond Value Formula - Crunch Numbers Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM, Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is the number of years until maturity. How do I Calculate Zero Coupon Bond Yield? - Smart Capital Mind The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ... Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as, This formula will then become, By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top, Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator How do you value a zero-coupon bond? The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is, Price = M / (1+r)n, where: M = maturity value or face value of the bond, r = rate of interest required, n = number of years to maturity, Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Example Zero-coupon Bond Formula, P = M / (1+r)n, variable definitions: P = price, M = maturity value, r = annual yield divided by 2, n = years until maturity times 2, The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Zero Coupon Bond Calculator - Calculator Academy The following formula is used to calculate the value of a zero-coupon bond. ZCBV = F / (1+r)^t, where ZCBV is the zero-coupon bond value, F is the face value of the bond, r is the yield/rate, t is the time to maturity, Zero Coupon Bond Definition, How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

What Is a Zero-Coupon Bond? | The Motley Fool Price of Zero-Coupon Bond = Face Value / (1+ interest rate/2) ^ time to maturity*2. With semiannual compounding, we see the bond offered at an initially deeper discount than if imputed interest ... Bond Pricing - Formula, How to Calculate a Bond's Price For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value. Each bond must come with a par value that is repaid at maturity. Without the ... Zero Coupon Bond Calculator - Nerd Counter Zero-Coupon Bond Yield = F 1/n, PV - 1, Here; F represents the Face or Par Value, PV represents the Present Value, n represents the number of periods, I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM Formula for Zero Coupon Bond Price : A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m (1 + r) n, Where, P = Zero-Coupon Bond Price, M = Face value at maturity or face value of bond,

Zero Coupon Bond Value Calculator Zero Coupon Bond Value calculator uses Zero Coupon Bond Value = Face Value/ (1+Rate of Return/100)^Time to Maturity to calculate the Zero Coupon Bond Value, Zero Coupon Bond Value is referred to as a pure discount bond or simply discount bond, is a bond that does not pay coupon payments, and instead pays one lump sum at maturity.

Zero Coupon Bond Value Calculator - buyupside.com The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 . Related Calculators. Bond Convexity Calculator. Bond Duration Calculator - Macaulay Duration, Modified Macaulay Duration and Convexity Bond Present Value ...

Zero-Coupon Bond Definition - Investopedia The price of a zero-coupon bond can be calculated with the following equation: Zero-coupon bond price = Maturity value ÷ (1 + required interest rate)^number years to maturity, How Does the IRS Tax...

Zero Coupon Bond Calculator - What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator.

Zero Coupon Bond: Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond:

3. Compute the - wxmmv.mieszkanianadzalewem.pl 3. Compute the bond value by multiplying the percentage price quote by the bond's par value.For example, if a bond is quoted at 110.0 and has a. Jul 27, 2022 · Calculation of Bonds Value.The valuation of a bond is based on three factors. These are coupon rate, maturity date, and the current price. Based on these factors, the value of the bond can be easily calculated.

How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left...

Zero Coupon Bond Calculator - MiniWebtool The Zero Coupon Bond Calculator is used to calculate the zero-coupon bond value. Zero Coupon Bond Definition. A zero-coupon bond is a bond bought at a price lower than its face value, with the face value repaid at the time of maturity. It does not make periodic interest payments. When the bond reaches maturity, its investor receives its face ...

Bond Pricing Formula | How to Calculate Bond Price? | Examples Since the coupon rate is higher than the YTM, the bond price is higher than the face value, and as such, the bond is said to be traded at a premium. Example #3. Let us take the example of a zero-coupon bond. Let us assume a company QPR Ltd has issued a zero-coupon bond with a face value of $100,000 and matures in 4 years.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19, Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

How to Calculate the Price of a Zero Coupon Bond To figure the price you should pay for a zero-coupon bond, you'll follow these steps: Divide your required rate of return by 100 to convert it to a decimal. Add 1 to the required rate of return as a decimal. Raise the result to the power of the number of years until the bond matures.

Zero-Coupon Bond: Formula and Calculator - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula, Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1, Interest Rate Risks and "Phantom Income" Taxes,

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

Post a Comment for "43 how to calculate zero coupon bond price"