41 t bill coupon rate

Coupon Rate Definition - Investopedia A coupon rate is the nominal yield paid by a fixed-income security. It is the annual coupon payments paid by the issuer relative to the bond's face or par value. What Are Treasury Bills (T-Bills) and How Do They Work? Jun 02, 2022 · Treasury Bill - T-Bill: A Treasury bill (T-Bill) is a short-term debt obligation backed by the Treasury Dept. of the U.S. government with a maturity of less than one year, sold in denominations of ...

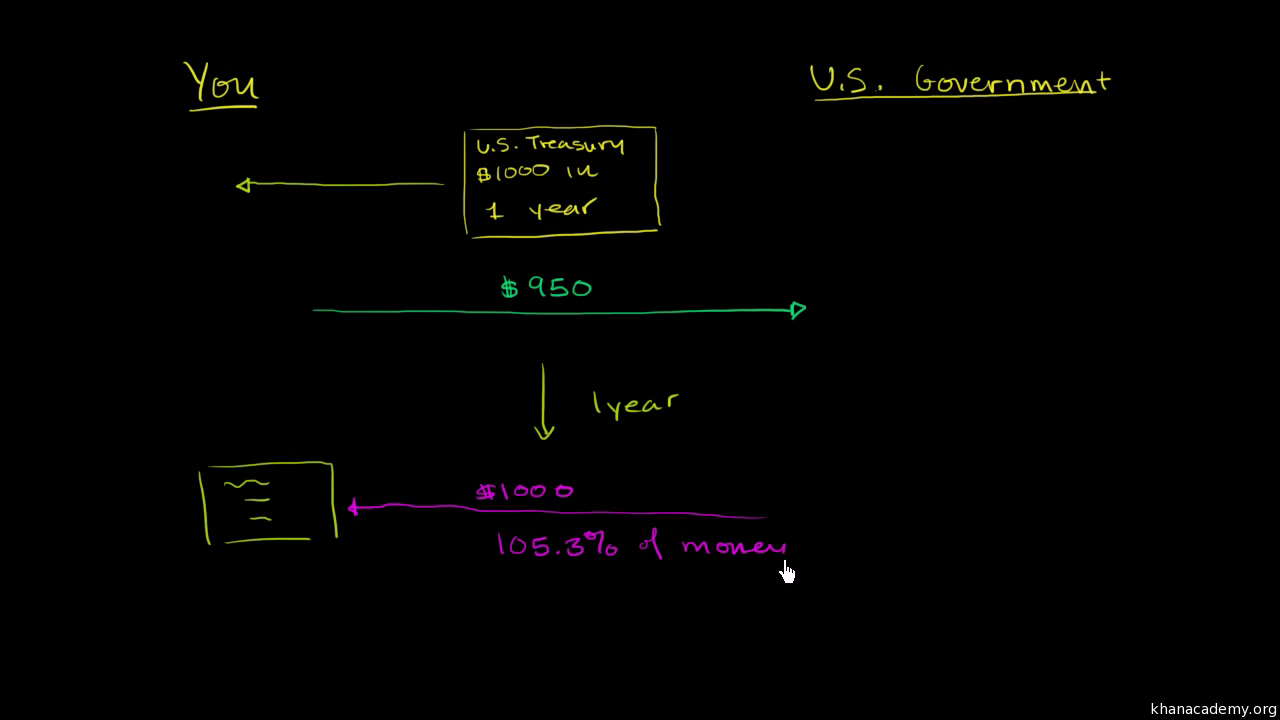

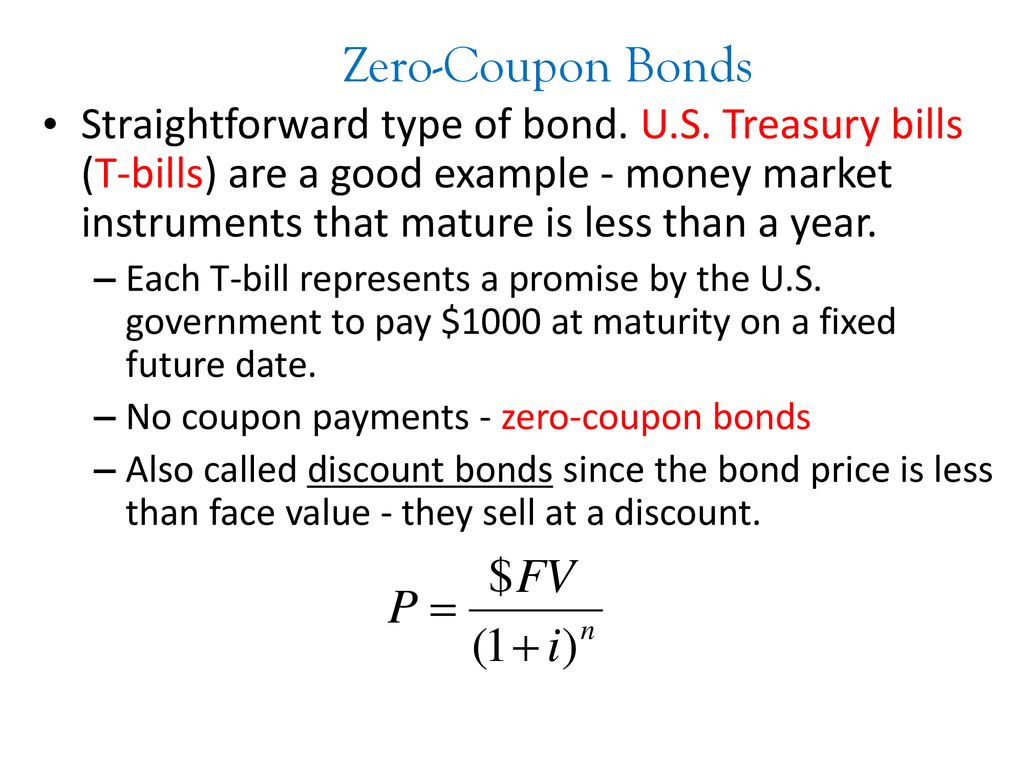

The Basics of the T-Bill - Investopedia A Treasury Bill or T-Bill is a debt obligation issued by the U.S. Department of the Treasury. Of the debt issued by the U.S. government, the T-Bill has the shortest maturity, ranging from a few days to one year. T-Bills are typically sold at a discount to par value (also known as face value). When the bill matures, you are paid par value. The diffe...

T bill coupon rate

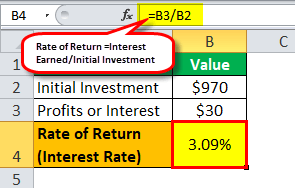

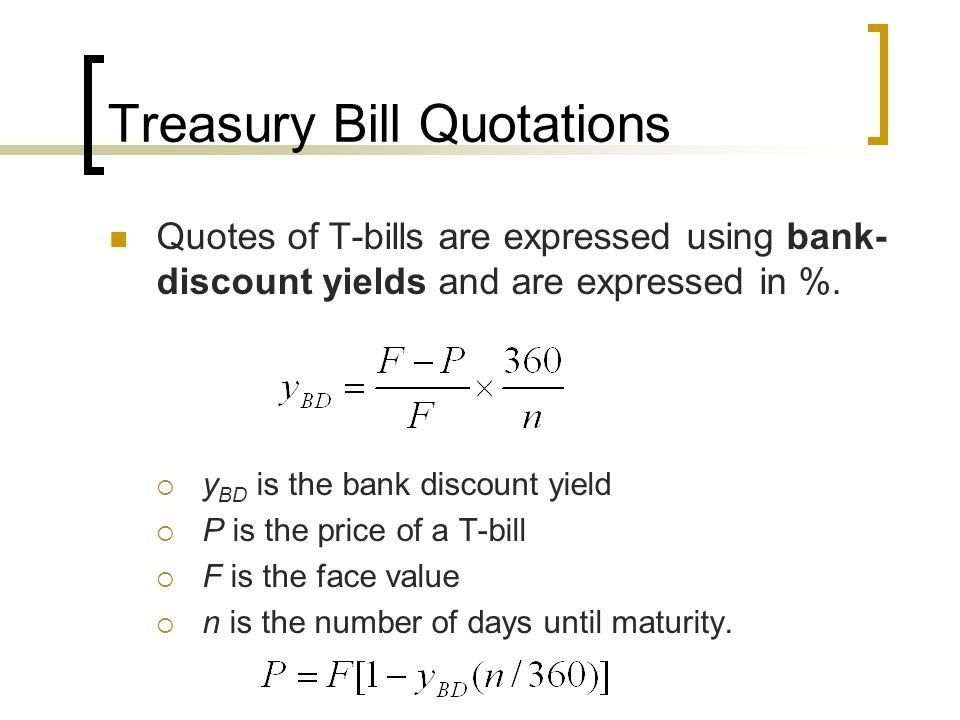

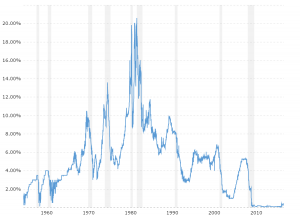

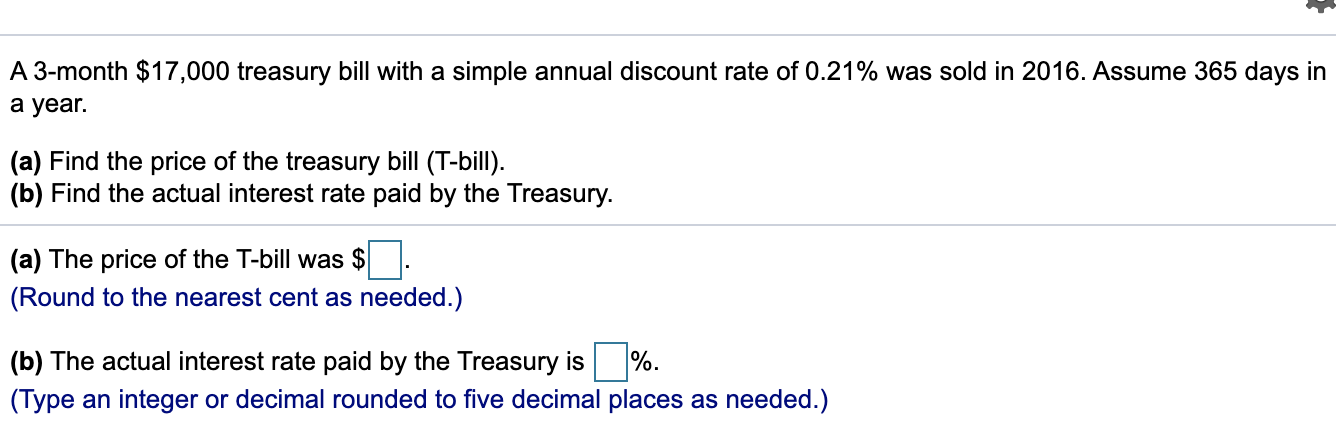

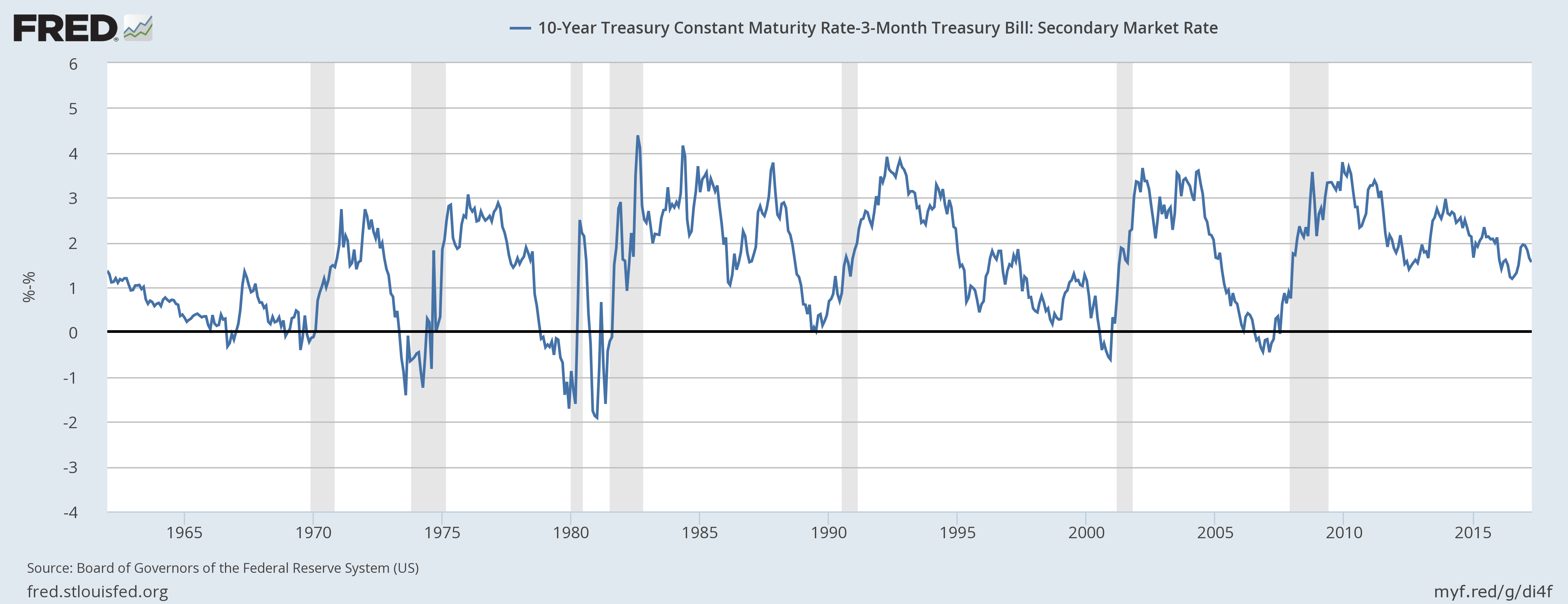

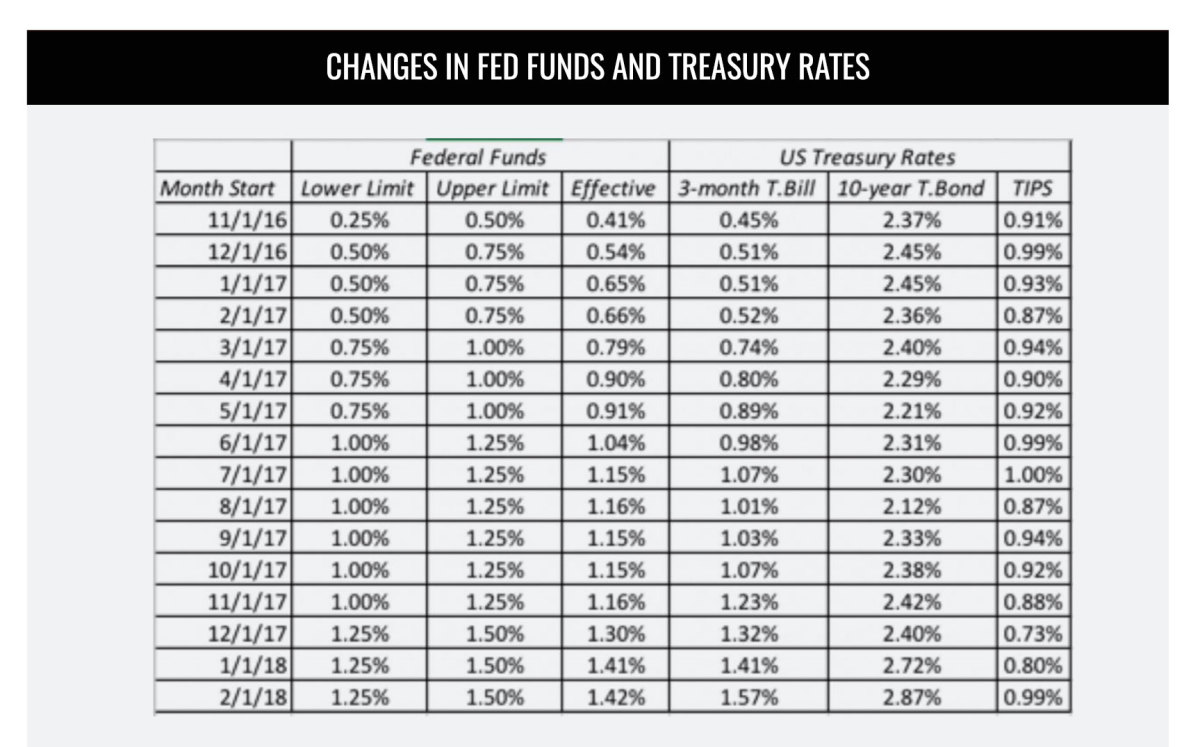

Are T-Bills "coupon equivalent" rates based in annual terms? According to treasury.gov, the "coupon equivalent" for a 1 month (4 weeks) T-Bill issued today is 0.99%. I happened to have purchased a 1 month T-Bill today for $99.9246. By my calculation that means that the return will be .075% (.0754/99.9246) for the month. How Are Treasury Bill Interest Rates Determined? - Investopedia U.S. Treasury bills (T-bills) are typically sold at a discount from their par value. The level of discount is determined during Treasury auctions. Unlike other U.S. Treasury securities such as Treasury notes (T-notes) and Treasury bonds (T-bonds), T-bills do not pay periodic interest at six-month intervals. The interest rate for Treasuries is therefore determined through a combination of the total discounted value and the maturity length. 1 Treasury Bills — TreasuryDirect Also see Understanding pricing and interest rates. Interest paid: When the bill matures: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency: Every four weeks for 52-week bills

T bill coupon rate. Treasury Bills (T-Bills) - Meaning, Examples, Calculations While the minimum purchase is just $100, up to $5 million non-competitive T-Bills can be purchased in a single auction. Competitive ones can be purchased up to 35% of the offering amount. According to US Treasury Department, the treasury bills rates on 3 rd September 2021 were as follows: Treasury Bills — TreasuryDirect Also see Understanding pricing and interest rates. Interest paid: When the bill matures: Minimum purchase: $100: In increments of: $100: Maximum purchase: $10 million (non-competitive bid) 35% of offering amount (competitive bid) (See Buying a Treasury marketable security for information on types of bids.) Auction frequency: Every four weeks for 52-week bills How Are Treasury Bill Interest Rates Determined? - Investopedia U.S. Treasury bills (T-bills) are typically sold at a discount from their par value. The level of discount is determined during Treasury auctions. Unlike other U.S. Treasury securities such as Treasury notes (T-notes) and Treasury bonds (T-bonds), T-bills do not pay periodic interest at six-month intervals. The interest rate for Treasuries is therefore determined through a combination of the total discounted value and the maturity length. 1 Are T-Bills "coupon equivalent" rates based in annual terms? According to treasury.gov, the "coupon equivalent" for a 1 month (4 weeks) T-Bill issued today is 0.99%. I happened to have purchased a 1 month T-Bill today for $99.9246. By my calculation that means that the return will be .075% (.0754/99.9246) for the month.

:max_bytes(150000):strip_icc()/us_treasury_bond-5bfc2f31c9e77c002631087a.jpg)

:max_bytes(150000):strip_icc()/Treasury-yield_final-40eecf2eabbe467da15e4b7d7ea949ff.png)

![1. [20 points] You observe the following Treasury | Chegg.com](https://media.cheggcdn.com/media/650/6508e20f-7fc9-4883-84b5-52f927a66237/phpd9nuhw.png)

:max_bytes(150000):strip_icc()/Which-economic-factors-impact-treasury-yields_final-676fd306bca34abfb85e4869ff63259a.png)

Post a Comment for "41 t bill coupon rate"