41 ytm zero coupon bond

Interest Rate Statistics | U.S. Department of the Treasury WebNOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market … Zero Coupon Bond Yield Calculator - YTM of a discount bond - Vin Zero Coupon Bond Yield Calculator. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. These bonds are issued at a discount to their face value and therefore the difference between the face value of the bond and its issue price represents the interest yield of the bond.

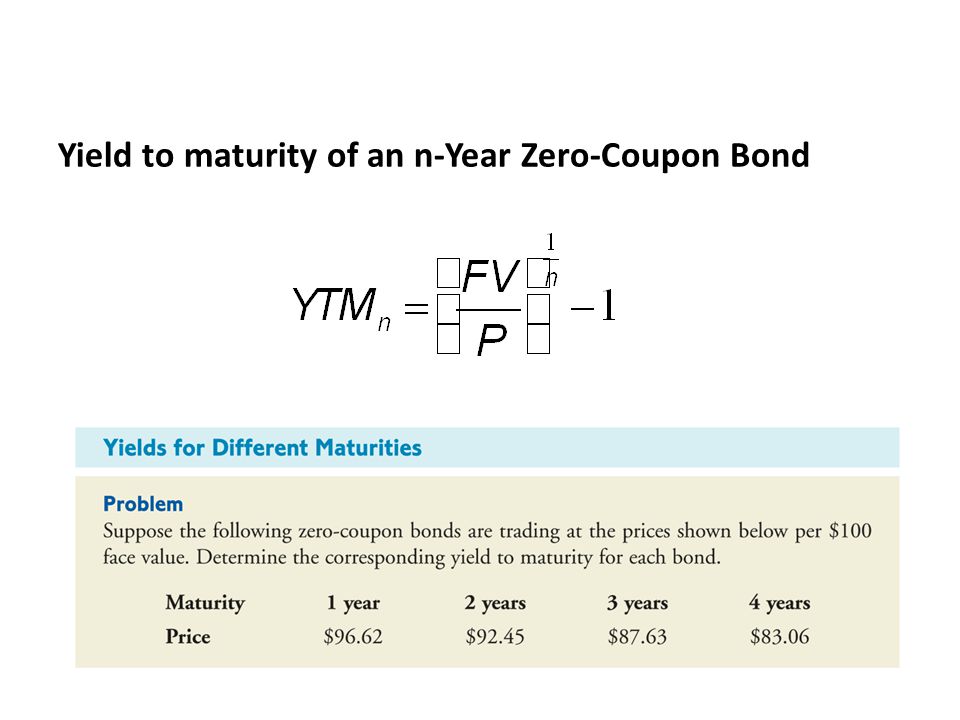

How to Calculate Yield to Maturity of a Zero-Coupon Bond Oct 10, 2022 · Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

Ytm zero coupon bond

Calculating the Yield of a Zero Coupon Bond - YouTube This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to calculate the YTM of an... How to compute the YTM of a zero coupon bond when price is ... - YouTube I start with a zero coupon bond price that is stated as a percentage of par value. I then compute the bond's YTM.==I'm a Finance Professor at the University ... Calculate the YTM of a Zero Coupon Bond - YouTube This video explains how to calculate the yield to maturity (YTM) of a zero coupon bond using the lump sum formula.

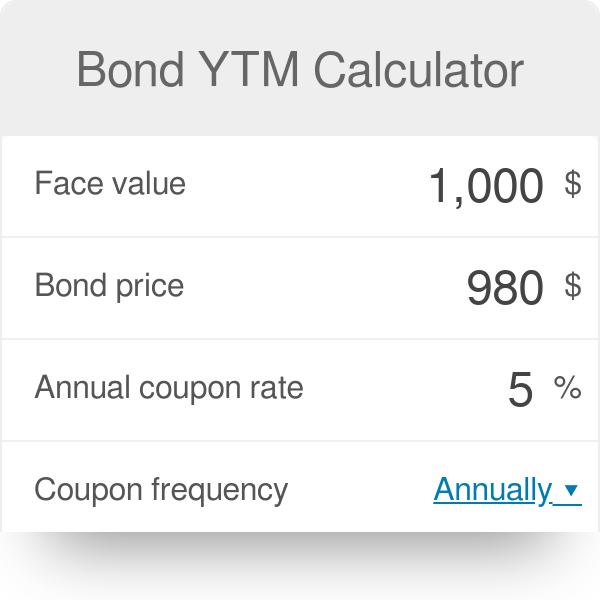

Ytm zero coupon bond. Bond Yield to Maturity (YTM) Calculator - DQYDJ The Bond Yield to Maturity Calculator computes YTM using duration, coupon, and price. The approximate and exact yield to maturity formula are inside. ... and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600; Par ... Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments. Zero Coupon Bond Value Calculator: Calculate Price, Yield to … P = M / (1+r)n variable definitions: 1. P = price 2. M = maturity value 3. r = annual yield divided by 2 4. n = years until maturity times 2 The above formula is the one we use in our calculator to calculate the discount to face value every half-year throughout the duration of the bond's term. Here is an example calculation for the purchase price o... Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Other Financial Basics Calculators. Zero coupon bonds are yet another interesting security in the fixed income world.

Yield to Maturity (YTM): What It Is, Why It Matters, Formula Web31.05.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ... Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The zero coupon bond effective yield formula is used to calculate the periodic return for a zero coupon bond, or sometimes referred to as a discount bond. A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at ... Yield to maturity - Wikipedia WebIf a bond's coupon rate is more than its YTM, then the bond is selling at a premium. If a bond's coupon rate is equal to its YTM, ... Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. The yield to maturity on 1 year zero coupon bonds is...ask 1 The yield to maturity on 1 year zero coupon bonds is currently 7%, the YTM on 2 year zero is 8%. The treasury plans to issue a 2 year maturity coupon bind, paying coupons once per year with a coupon rate of 9$. The face value of the bond is $100. A/ At what price will the bond sell?

CALCULATION OF YTM OF ZERO COUPON BOND USING EXCEL | Dr Abhishek ... In this lecture I am explaining how to #TYM#YieldToMaturity#HOW_TO_CALCULATE_YIELD_ON_ZERO_COUPON_BOND #YTM_IN_EXCEL calculate the yield on zero COUPON bond ... Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Let's understand the concept of this Bond with the help of an example: Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19. Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of ... Yield to Maturity (YTM) - Definition, Formula, Calculation Examples Coupons on the bond Coupons On The Bond Coupon bonds pay fixed interest at a predetermined frequency from the bond's issue date to the bond's maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest rate. read more will be $1,000 * 8%, which is $80. What is a Zero Coupon Bond? Who Should Invest? | Scripbox For example, if the bond's face value is Rs.100, and it pays an interest of 8%. Here, the interest rate is the bond coupon. What is yield to maturity for a zero coupon bond? Yield is a measure of all the cash flows of an investment over a period of time. It considers all the coupon payments and dividends received during the term of an investment.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Web= $838.79. Therefore, each bond will be priced at $838.79 and said to be traded at a discount (bond price lower than par value) because the coupon rate Coupon Rate The coupon rate is the ROI (rate of interest) paid on the bond's face value by the bond's issuers. It determines the repayment amount made by GIS (guaranteed income security). …

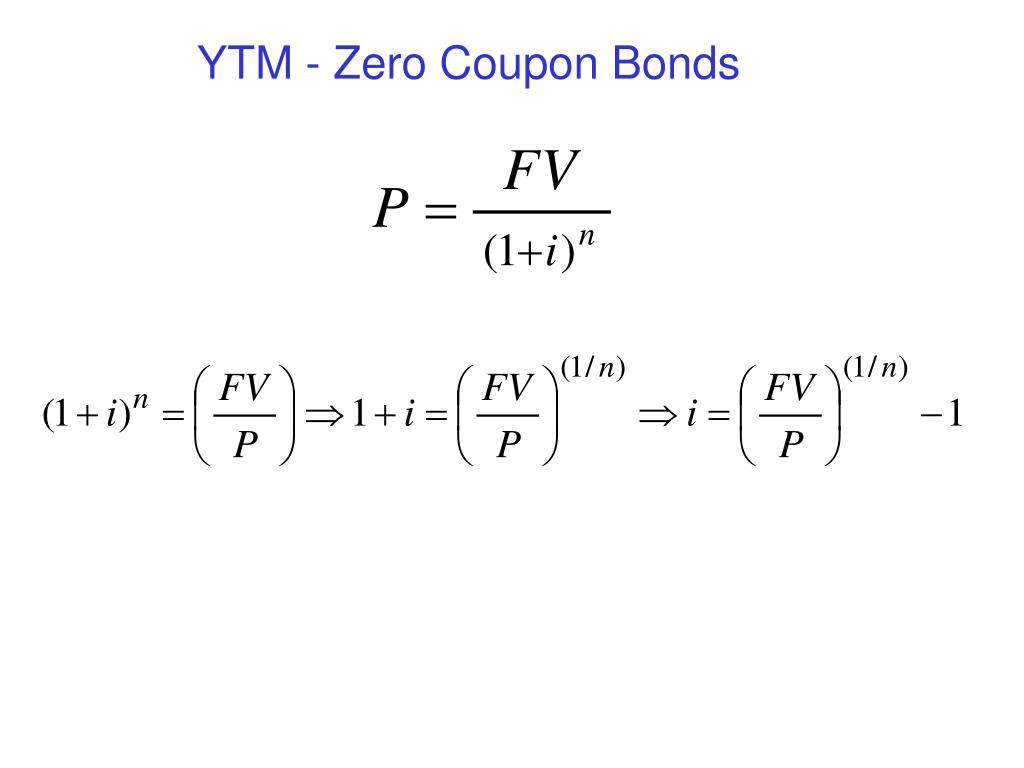

Zero-Coupon Bonds: Characteristics and Calculation Zero-Coupon Bond Yield-to-Maturity (YTM) Formula. The yield-to-maturity (YTM) is the rate of return received if an investor purchases a bond and proceeds to hold onto it until maturity. In the context of zero-coupon bonds, the YTM is the discount rate (r) that sets the present value (PV) of the bond’s cash flows equal to the current market price.

Return of zero coupon bond in Excel. YTM of zero coupon bond with Excel ... Learn how to calculate yield to maturity (YTM) of a zero coupon bond with excel. @RK varsity

Yield to Maturity (YTM): Formula and Bond Calculation - Wall … WebStep 3. Semi-Annual Coupon Payment on Bond Calculation. As for our last input, we multiply the semi-annual coupon rate by the face value of the bond (FV) to arrive at the semi-annual coupon of the bond. Step 4. Yield to Maturity Calculation Example. With all required inputs complete, we can calculate the semi-annual yield to maturity (YTM).

What Is a Zero-Coupon Bond? - Investopedia A zero-coupon bond, also known as an accrual bond, is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value.

Treasuries - WSJ WebWe are in the process of updating our Market Data experience and we want to hear from you. Please send us your feedback via our Customer Center

Calculate the YTM of a Zero Coupon Bond - YouTube This video explains how to calculate the yield to maturity (YTM) of a zero coupon bond using the lump sum formula.

How to compute the YTM of a zero coupon bond when price is ... - YouTube I start with a zero coupon bond price that is stated as a percentage of par value. I then compute the bond's YTM.==I'm a Finance Professor at the University ...

Calculating the Yield of a Zero Coupon Bond - YouTube This video demonstrates how to calculate the yield-to-maturity of a zero-coupon bond. It also provides a formula that can be used to calculate the YTM of an...

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "41 ytm zero coupon bond"