43 yield to maturity of zero coupon bond

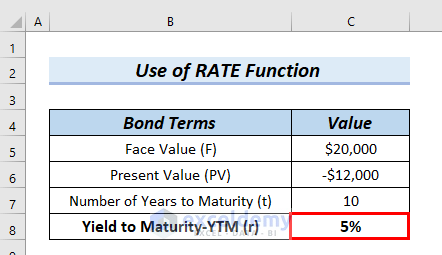

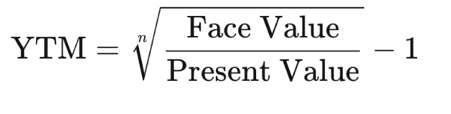

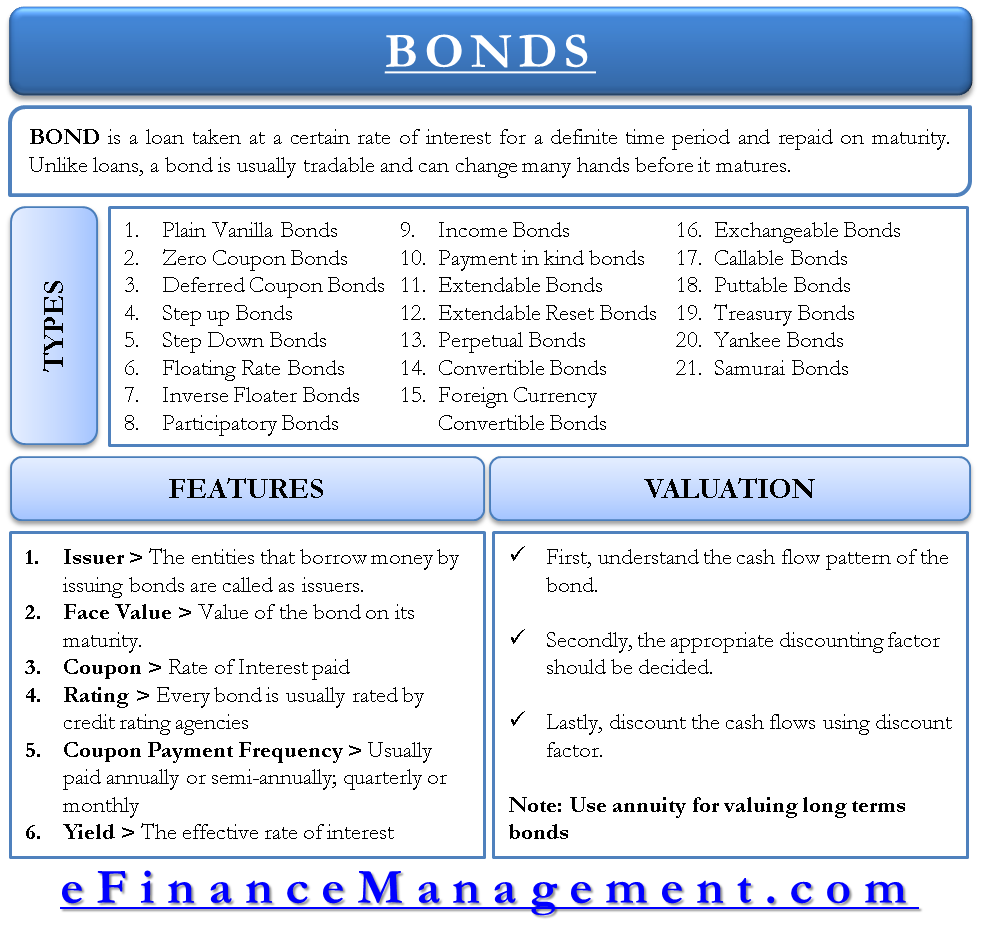

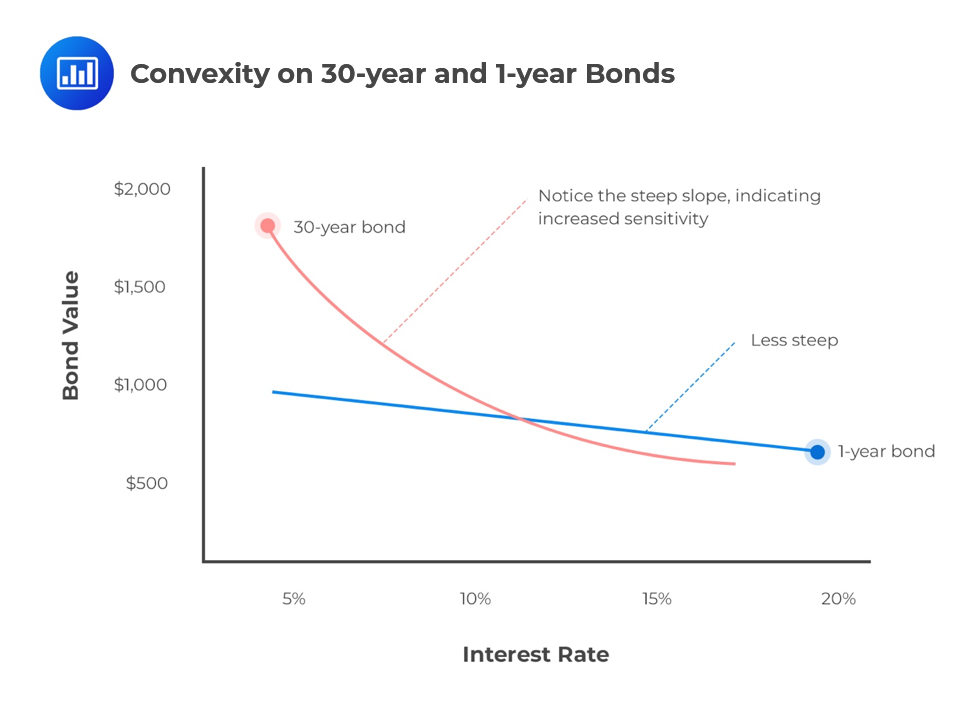

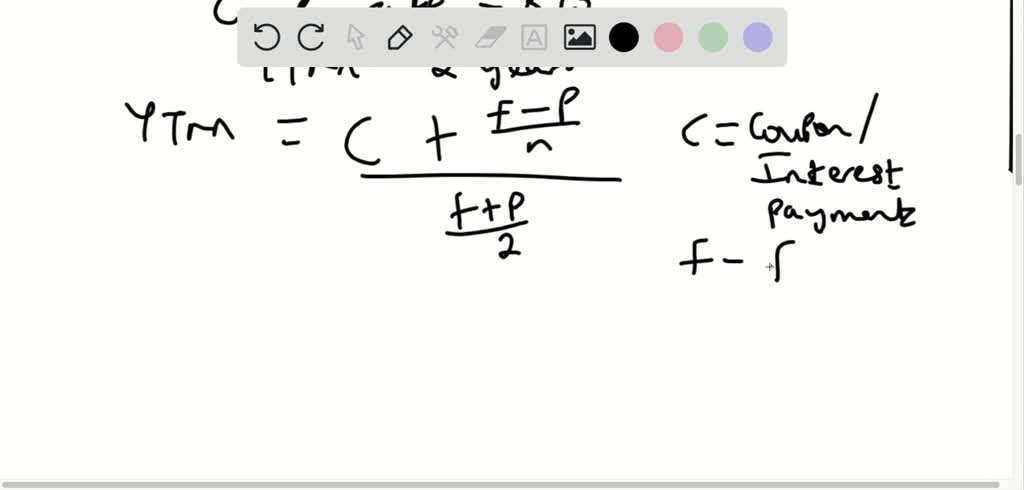

Important Differences Between Coupon and Yield to Maturity - The Balance The yield increases from 2% to 4%, which means that the bond's price must fall. Keep in mind that the coupon is always 2% ($20 divided by $1,000). That doesn't change, and the bond will always payout that same $20 per year. But when the price falls from $1,000 to $500, the $20 payout becomes a 4% yield ($20 divided by $500 gives us 4%). Yield to Maturity (YTM) Definition & Example | InvestingAnswers The estimated YTM for this bond is 13.220%. How Yield to Maturity Is Calculated (for Zero Coupon Bonds) Since zero coupon bonds don't have recurring interest payments, they don't have a coupon rate. The zero coupon bond formula is as follows:

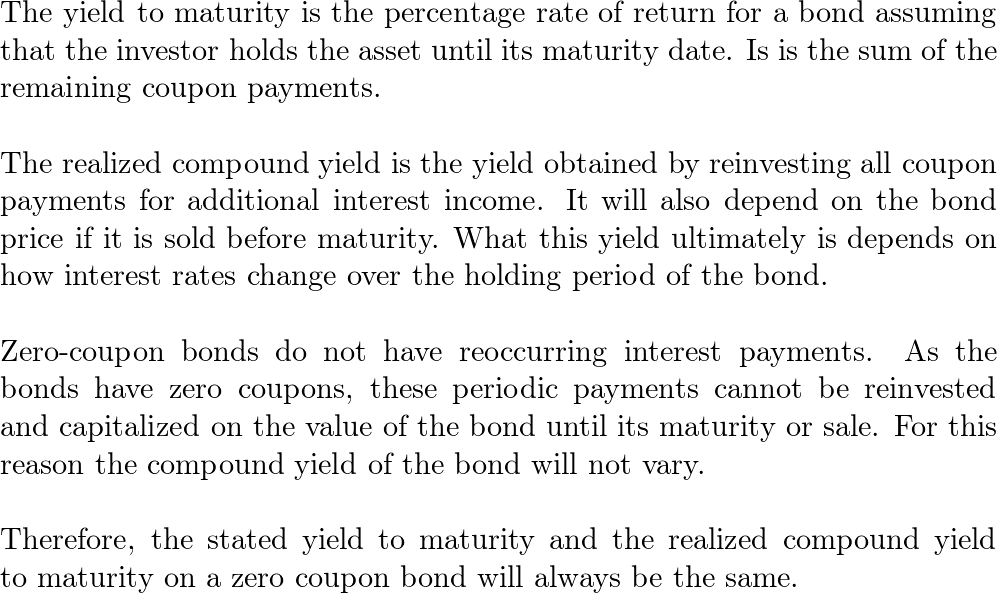

Yield to Maturity (YTM): What It Is, Why It Matters, Formula 31.5.2022 · Yield to maturity (YTM) is the total return anticipated on a bond if the bond is held until it matures. Yield to maturity is considered a long-term bond yield , but is expressed as an annual rate ...

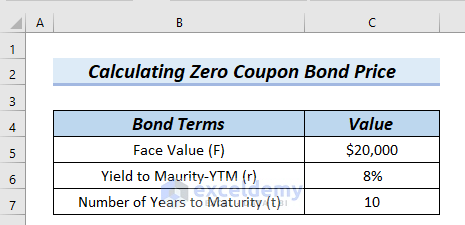

Yield to maturity of zero coupon bond

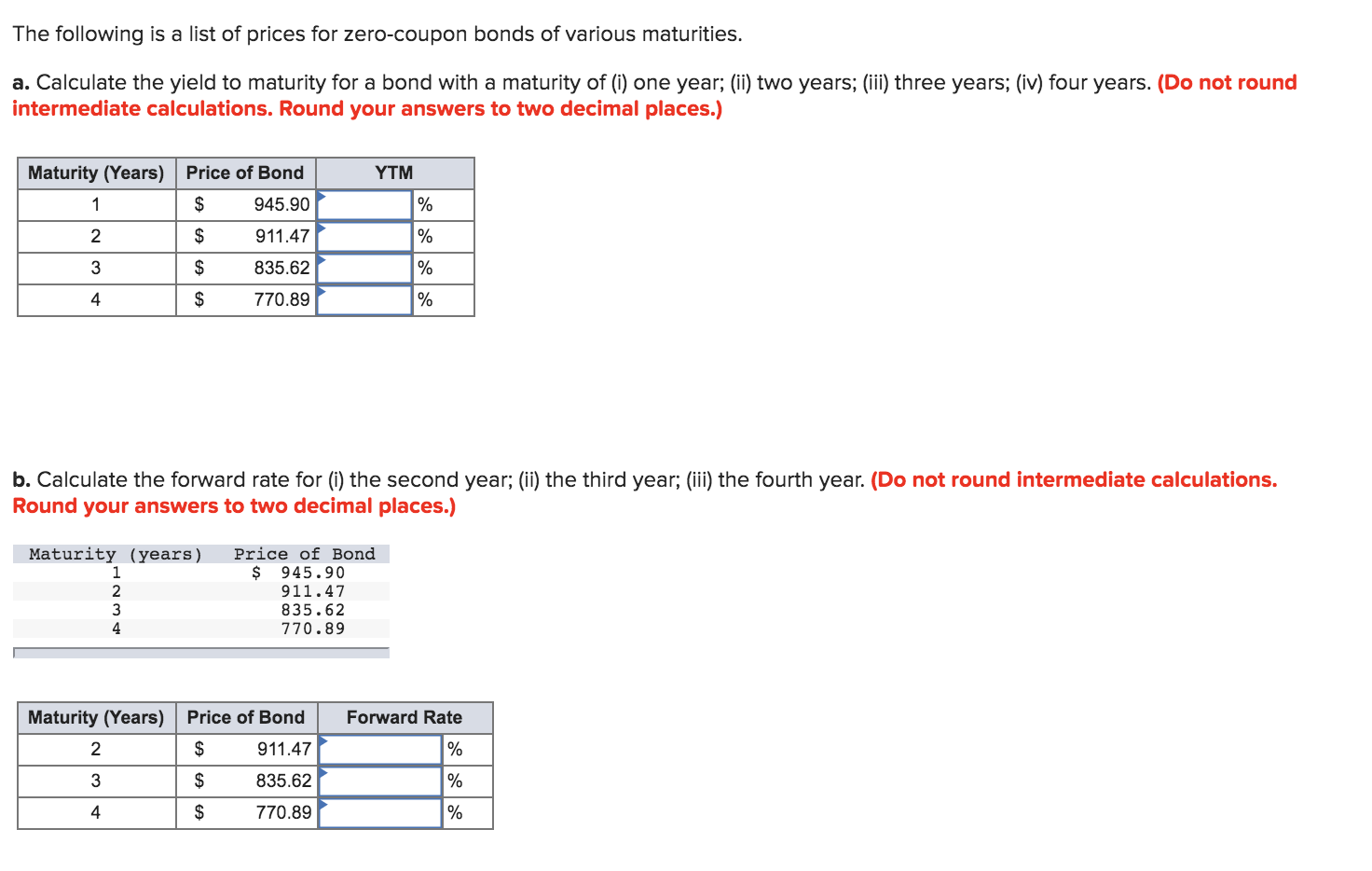

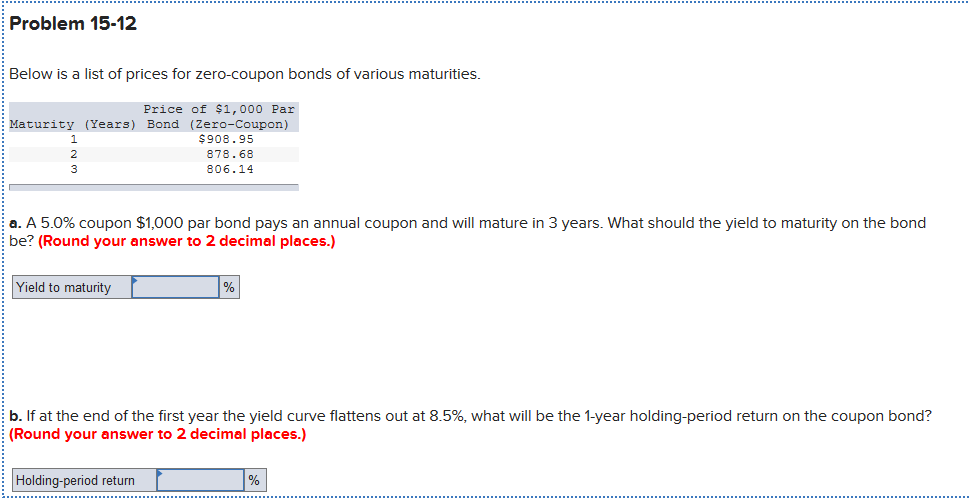

Bonds Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000. If the bond matures in eight years, the bond should sell for a price of _____ today. ... a 15-year zero-coupon bond that has a par value of $1,000, and a required return of 8% would be priced at approximately A. $308. B. $315. C. $464. D. $555. E. None of the options Solved The yield to maturity on one-year zero-coupon bonds | Chegg.com The yield to maturity on one-year zero-coupon bonds is 8.4%. The yield to maturity on two-year zero-coupon bonds is 9.4%. a. What is the forward rate of interest for the second year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Forward rate of interest % b. If you believe in the expectations hypothesis, The yield to maturity on 1 year zero coupon bonds is...ask 1 The yield to maturity on 1 year zero coupon bonds is currently 7%, the YTM on 2 year zero is 8%. The treasury plans to issue a 2 year maturity coupon bind, paying coupons once per year with a coupon rate of 9$. The face value of the bond is $100. A/ At what price will the bond sell?

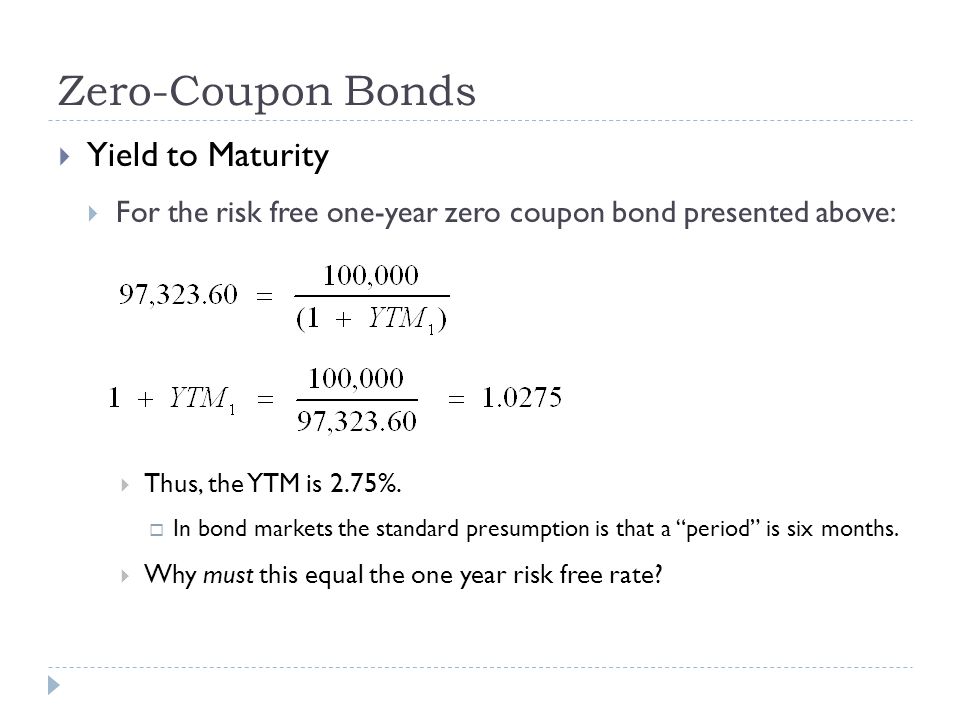

Yield to maturity of zero coupon bond. Yield to maturity - Wikipedia Then continuing by trial and error, a bond gain of 5.53 divided by a bond price of 99.47 produces a yield to maturity of 5.56%. Also, the bond gain and the bond price add up to 105. Finally, a one-year zero-coupon bond of $105 and with a yield to maturity of 5.56%, calculates at a price of 105 / 1.0556^1 or 99.47. Coupon-bearing Bonds Zero-Coupon Bond - Definition, How It Works, Formula Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded semi-annually. What price will John pay for the bond today? Zero-Coupon Bonds: Characteristics and Calculation - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below:

Value and Yield of a Zero-Coupon Bond | Formula & Example - XPLAIND.com The bonds were issued at a yield of 7.18%. The forecasted yield on the bonds as at 31 December 20X3 is 6.8%. Find the value of the zero-coupon bond as at 31 December 2013 and Andrews expected income for the financial year 20X3 from the bonds. Value (31 Dec 20X3) =. $1,000. = $553.17. (1 + 6.8%) 9. Value of Total Holding = 100 × $553.17 ... Yield to Maturity (YTM) - Definition, Formula, Calculation Examples We can use the above formula to calculate approximate yield to maturity. Coupons on the bond will be $1,000 * 8%, which is $80. Yield to Maturity (Approx) = (80 + (1000 - 94) / 12 ) / ( (1000 + 940) / 2) YTM will be - Example #2 FANNIE MAE is one of the famous brands trading in the US market. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P = price; n = years until maturity; Advantages of Zero-coupon Bonds. Most bonds typically pay out a coupon every six months. Yield to Maturity (YTM): Formula and Bond Calculation The relationship between the yield to maturity and coupon rate (and current yield) are as follows. YTM < Coupon Rate and Current Yield → The bond is being sold at a “premium” to its par value. YTM > Coupon Rate and Current Yield → The bond is being sold at a “discount” to its par value.

Zero Coupon Bond Calculator 【Yield & Formula】 - Nerd Counter The formula is mentioned below: Zero-Coupon Bond Yield = F 1/n. PV - 1. Here; F represents the Face or Par Value. PV represents the Present Value. n represents the number of periods. I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Zero-coupon bond - Wikipedia A zero coupon bond (also discount bond or deep discount bond) is a bond in which the face value is repaid at the time of maturity. Unlike regular bonds, it does not make periodic interest payments or have so-called coupons, hence the term zero-coupon bond.When the bond reaches maturity, its investor receives its par (or face) value. Examples of zero-coupon … Solved The yield to maturity on one-year zero-coupon bonds | Chegg.com The yield to maturity on one-year zero-coupon bonds is \( 7.2 \% \). The yield to maturity on two-year zero-coupon bonds is \( 8.2 \% \). Required: a. What is the forward rate of interest for the second year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) b. If you believe in the expectations hypothesis, what ... Bond Yield to Maturity (YTM) Calculator - DQYDJ The Bond Yield to Maturity Calculator computes YTM using duration, coupon, and price. The approximate and exact ... and a present value (current value). This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600; Par Value: $1000; Years to Maturity: 3;

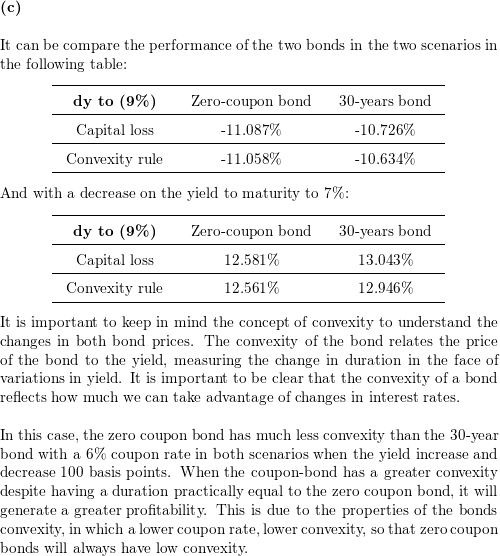

Solved: A newly issued 20-year maturity, zero-coupon bond A newly issued 20-year maturity, zero-coupon bond is issued with a yield to maturity of 3.5% and face value $1,000. Find the imputed interest income in: (a) the first year; (b) the second year; and (c) the last year of the bond's life.(Round your answers to 2 decimal places.)

Zero Coupon Bond | Investor.gov Zero Coupon Bond. Zero coupon bonds are bonds that do not pay interest during the life of the bonds. Instead, investors buy zero coupon bonds at a deep discount from their face value, which is the amount the investor will receive when the bond "matures" or comes due. The maturity dates on zero coupon bonds are usually long-term—many don't ...

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas A zero coupon bond is a bond that does not pay dividends (coupons) per period, but instead is sold at a discount from the face value. For example, an investor purchases one of these bonds at $500, which has a face value at maturity of $1,000.

Solved The yield to maturity on 1-year zero-coupon bonds is | Chegg.com The yield to maturity on 1-year zero-coupon bonds is currently 6%; the YTM on 2-year zeros is 7%.The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 8.5%.The face value of the bond is $100.a.

How to Calculate Yield to Maturity of a Zero-Coupon Bond 10.10.2022 · Yield to maturity (YTM) tells bonds investors what their total return would be if they held the bond until maturity. YTM takes into account the regular coupon payments made plus the return of ...

Yield to Maturity vs. Coupon Rate: What's the Difference? 20.5.2022 · The yield to maturity (YTM) is the percentage rate of return for a bond assuming that the investor holds the asset until its maturity date. It is the sum of all of its remaining coupon payments.

Solved The yield to maturity on a 1-year zero-coupon bond is - Chegg You'll get a detailed solution from a subject matter expert that helps you learn core concepts. See Answer The yield to maturity on a 1-year zero-coupon bond is currently 7%; the YTM on 2-year zeros is 8%. The Treasury plans to issue a 2-year maturity coupon bond, paying coupons once per year with a coupon rate of 9%.

Zero Coupon Bond Calculator – What is the Market Price? - DQYDJ P: The par or face value of the zero coupon bond; r: The interest rate of the bond; t: The time to maturity of the bond; Zero Coupon Bond Pricing Example. Let's walk through an example zero coupon bond pricing calculation for the default inputs in the tool. Face value: $1000; Interest Rate: 10%; Time to Maturity: 10 Years, 0 Months ...

Solved You find a zero coupon bond with a par value of | Chegg.com Finance questions and answers. You find a zero coupon bond with a par value of $10,000 and 24 years to maturity. If the yield to maturity on this bond is 4.2 percent, what is the price of the bond? Assume semiannual compounding periods. (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Yield Curves for Zero-Coupon Bonds - Bank of Canada These files contain daily yields curves for zero-coupon bonds, generated using pricing data for Government of Canada bonds and treasury bills. Each row is a single zero-coupon yield curve, with terms to maturity ranging from 0.25 years (column 1) to 30.00 years (column 120). The data are expressed as decimals (e.g. 0.0500 = 5.00% yield).

Zero-Coupon Bond: Definition, How It Works, and How To Calculate May 31, 2022 · Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping As the face value paid at the maturity date remains the same (1,000), the price investors are willing to pay to buy the zero coupon bonds must fall from 816 to 751, in order from the return to increase from 7% to 10%. Bond Price and Term to Maturity The longer the term the zero coupon bond is issued for the lower the bond price will be.

Understanding Bond Prices and Yields - Investopedia Jun 28, 2007 · At issuance, a bond's yield will equal the coupon rate if the bond was issued at par value. ... How to Calculate Yield to Maturity of a Zero-Coupon Bond. Investing. 4 Basic Things to Know About Bonds.

Solved 15, A zero-coupon bond has a yield to maturity of 9% - Chegg 15, A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000 if the bond matures in eight years, the bond should sell for a price of A. $422.41 B. $501.87 C. $513.16 D. $483 49 today 16.

Interest Rate Statistics | U.S. Department of the Treasury NOTICE: See Developer Notice on changes to the XML data feeds. Daily Treasury PAR Yield Curve Rates This par yield curve, which relates the par yield on a security to its time to maturity, is based on the closing market bid prices on the most recently auctioned Treasury securities in the over-the-counter market. The par yields are derived from input market prices, which are indicative ...

The yield to maturity on 1 year zero coupon bonds is...ask 1 The yield to maturity on 1 year zero coupon bonds is currently 7%, the YTM on 2 year zero is 8%. The treasury plans to issue a 2 year maturity coupon bind, paying coupons once per year with a coupon rate of 9$. The face value of the bond is $100. A/ At what price will the bond sell?

Solved The yield to maturity on one-year zero-coupon bonds | Chegg.com The yield to maturity on one-year zero-coupon bonds is 8.4%. The yield to maturity on two-year zero-coupon bonds is 9.4%. a. What is the forward rate of interest for the second year? (Do not round intermediate calculations. Round your answer to 2 decimal places.) Forward rate of interest % b. If you believe in the expectations hypothesis,

Bonds Flashcards | Quizlet A zero-coupon bond has a yield to maturity of 9% and a par value of $1,000. If the bond matures in eight years, the bond should sell for a price of _____ today. ... a 15-year zero-coupon bond that has a par value of $1,000, and a required return of 8% would be priced at approximately A. $308. B. $315. C. $464. D. $555. E. None of the options

:max_bytes(150000):strip_icc()/zero-couponbond_final-a6ec3618516a49c9a3654a1c79c9b681.png)

Post a Comment for "43 yield to maturity of zero coupon bond"