39 present value of zero coupon bond calculator

Zero Coupon Bond Value - Formula (with Calculator) Example of Zero Coupon Bond Formula A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value. Zero Coupon Bond Value Formula - Crunch Numbers How to calculate the price of a zero-coupon bond? Price of the zero-coupon bond is calculated much easier than a coupon bond price since there are no coupon payments. It is calculated as: P = \frac {M} { (1 + r)^ {n}} P = (1+r)nM. Where P is the current price of a bond, M is the face or nominal value, r is the required rate of interest, n is ...

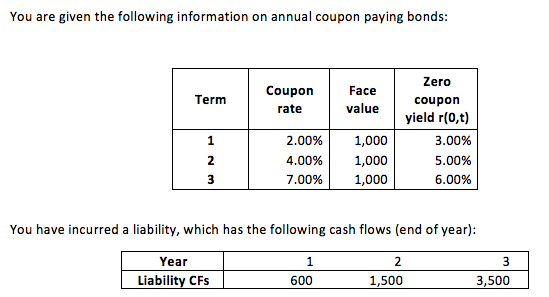

Bond Present Value Calculator Bond Present Value Calculator. Use the Bond Present Value Calculator to compute the present value of a bond. Input Form. Face Value is the value of the bond at maturity. Annual Coupon Rate is the yield of the bond as of its issue date. Annual Market Rate is the current market rate. It is also referred to as discount rate or yield to maturity.

Present value of zero coupon bond calculator

Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond. r = rate or yield. t = time to maturity. Job Finder - Search for Jobs Hiring. Summation (Sum) Calculator. Percent Off Calculator - Calculate Percentage. Solved 1. Calculate the present value of a $1000 zero-coupon - Chegg See Answer. 1. Calculate the present value of a $1000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. 2. Consider a coupon bond that has a $1000 par value and a coupon rate of 10%. The bond is currently selling for $1150 and has eight years to maturity. How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Present value of zero coupon bond calculator. PPIC Statewide Survey: Californians and Their Government Oct 27, 2022 · Key Findings. California voters have now received their mail ballots, and the November 8 general election has entered its final stage. Amid rising prices and economic uncertainty—as well as deep partisan divisions over social and political issues—Californians are processing a great deal of information to help them choose state constitutional officers and state legislators and to make ... Calculate the present value of a \( \$ 1,000 \) | Chegg.com Expert Answer. Transcribed image text: Calculate the present value of a $1,000 zero-coupon bond with 14 years to maturity if the yield to maturity is 5%. Round your answer to the nearest hundredth. Question 7 Calculate the duration of a $1,000,14% coupon bond with three years to maturity. Assume that all market interest rates are 10% ? Zero-Coupon Bonds: Characteristics and Examples - Wall Street Prep To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Interest Rate Risks and "Phantom Income" Taxes Zero Coupon Bond Value Calculator - buyupside.com Zero Coupon Bond Value Calculator Compute the value (price) of a zero coupon bond. The calculator, which assumes semi-annual compounding, uses the following formula to compute the value of a zero-coupon bond: Value = Face Value / (1 +Yield / 2) ** Years to Maturity * 2 Bond Convexity Calculator

Zero Coupon Bond Value Calculator To use this online calculator for Zero Coupon Bond Value, enter Face Value (F), Rate of Return (%RoR) & Time to Maturity (T) and hit the calculate button. Here is how the Zero Coupon Bond Value calculation can be explained with given input values -> 675.5642 = 1000/ (1+4/100)^10. FAQ What is Zero Coupon Bond Value? Bond Price Calculator – Present Value of Future Cashflows - DQYDJ Using the Bond Price Calculator Inputs to the Bond Value Tool. Bond Face Value/Par Value - Par or face value is the amount a bondholder will get back when a bond matures. Annual Coupon Rate - The annual coupon rate is the posted interest rate on the bond. In reverse, this is the amount the bond pays per year divided by the par value. Present Value Calculator home / financial / present value calculator Present Value Calculator This present value calculator can be used to calculate the present value of a certain amount of money in the future or periodical annuity payments. Present Value of Future Money Future Value (FV) Number of Periods (N) Interest Rate (I/Y) Results Present Value: $558.39 How to Calculate Yield to Maturity of a Zero-Coupon Bond - Investopedia The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows: \begin {aligned}=\left (\frac {1000} {925}\right)^ {\left...

Zero Coupon Bond Calculator - Nerd Counter Zero-Coupon Bond Yield = F 1/n PV - 1 Here; F represents the Face or Par Value PV represents the Present Value n represents the number of periods I feel it necessary to mention an example here that will make it easy to understand how to calculate the yield of a zero-coupon bond. Bond Yield Calculator - CalculateStuff.com Yield to maturity (YTM) is similar to current yield, but YTM accounts for the present value of a bond’s future coupon payments. In order to calculate YTM, we need the bond’s current price, the face or par value of the bond, the coupon value, and the number of years to maturity. The formula for calculating YTM is shown below: Bond Price Calculator | Formula | Chart To calculate the coupon per period you will need two inputs, namely the coupon rate and frequency. It can be calculated using the following formula: coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Zero Coupon Bond: Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond:

Coupon Rate Calculator | Bond Coupon You can find it by dividing the annual coupon payment by the face value: coupon rate = annual coupon payment / face value For Bond A, the coupon rate is $50 / $1,000 = 5%. Even though you now know how to find the coupon rate of a bond, you can always use this coupon rate calculator to estimate the result in no time!

Calculate the Value of a Zero-coupon Bond - Finance Train Fixed Income Calculate the Value of a Zero-coupon Bond Suppose you have a pure discount bond that will pay $1,000 five years from today. The bond discount rate is 12%. What is the appropriate price for this bond? Since there are no interim coupon payments, the value of the bond will simply be the present value of single payment at maturity.

Solved Calculate the present value of a $1,000 zero-coupon - Chegg Compute your rate of return if you sell the bond next year for $880.10. 7. Calculate the duration of a $1,000, 6% coupon bond with three years to maturity. Assume that all market interest rates are 7%. Expert Answer 100% (1 rating) 1. Present value of zero coupon bond = Face valu … View the full answer Previous question Next question

Zero-Coupon Bond Value | Formula, Example, Analysis, Calculator The value of a zero-coupon bond is determined by its face value, maturity date, and the prevailing interest rate. The formula to calculate the value of a zero-coupon bond is Price = M / (1+r)n where: M = maturity value or face value of the bond r = rate of interest required n = number of years to maturity 3.

Zero-Coupon Bond Value Calculator - MYMATHTABLES.COM A zero-coupon bond is a debt security that does not pay interest but instead trades at a deep discount, rendering a profit at maturity, when the bond is redeemed for its full face value. P = m (1 + r) n. Where, P = Zero-Coupon Bond Price. M = Face value at maturity or face value of bond. r = annual yield or rate.

Coupon Bond Formula | How to Calculate the Price of Coupon Bond? Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n] You are free to use this image on your website, templates, etc, Please provide us with an attribution link where C = Periodic coupon payment, P = Par value of bond,

1. Calculate the present value of a $1,000 zero-coupon bond...get 5 1. Calculate the present value of a $1,000 zero-coupon bond with six years to maturity if the yield to maturity is 7%. 2. A lottery claims its grand prize is $20 million, payable over 40 years at $500,000 per year. If the first payment is made immediately, what is the grand prize worth? Use an interest rate of 12%.

Zero Coupon Bond Calculator – What is the Market Value? Zero Coupon Bond Calculator Inputs Bond Face Value/Par Value ($) - The face or par value of the bond - essentially, the value of the bond on its maturity date. Annual Interest Rate (%) - The interest rate paid on the zero coupon bond. Years to Maturity - The numbers of years until the zero coupon bond's maturity date.

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as. This formula will then become. By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top.

How to Calculate PV of a Different Bond Type With Excel - Investopedia The Accrued Interest = ( Coupon Rate x elapsed days since last paid coupon ) ÷ Coupon Day Period. For example: Company 1 issues a bond with a principal of $1,000, paying interest at a rate of 5% ...

Zero Coupon Bond Value Calculator - Find Formula, Example & more A zero coupon bond which has a face value of Rs.1000 is issued at the rate of 6%. So, now let us solve it. The formula is: Zero Coupon Bond Value = Face Value of Bond / (1 + Rate of Yield) ^ Time of Maturity. Following which the workout will be: Zero Coupon Bond Value = 1000 / (1 + 6) ^ 5. When we solve the equation barely by hand or use the ...

Bond Valuation: Calculation, Definition, Formula, and Example May 31, 2022 · Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ...

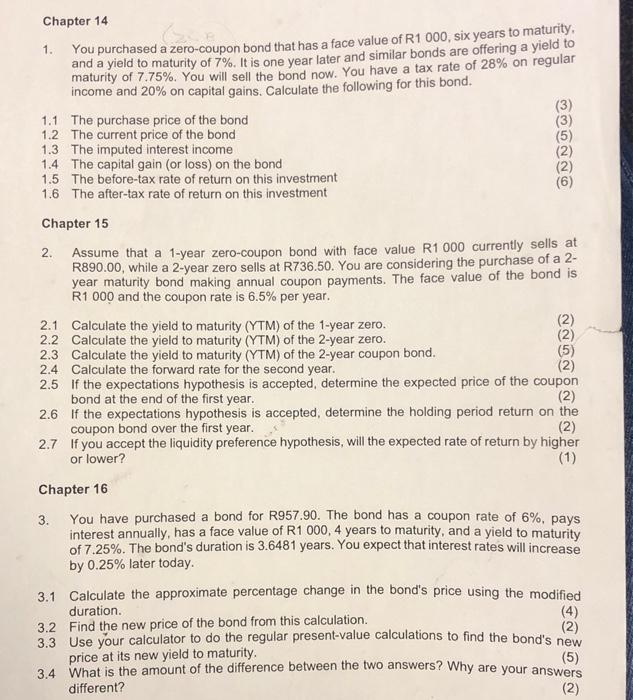

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816)

Solved 1. Calculate the present value of a $1000 zero-coupon - Chegg See Answer. 1. Calculate the present value of a $1000 zero-coupon bond with five years to maturity if the yield to maturity is 6%. 2. Consider a coupon bond that has a $1000 par value and a coupon rate of 10%. The bond is currently selling for $1150 and has eight years to maturity.

Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond. r = rate or yield. t = time to maturity. Job Finder - Search for Jobs Hiring. Summation (Sum) Calculator. Percent Off Calculator - Calculate Percentage.

Post a Comment for "39 present value of zero coupon bond calculator"